Theoretically, your car insurance quote should be based on how much of a risk your insurance provider thinks you are. But in some states, your gender affects your rate more than your risk factor.

A new report conducted by The Zebra found that women pay more for car insurance in 25 states, despite the fact that men are more likely to engage in risky driving behavior. Confusingly, the disparity appears to be a recent phenomenon. Just two years ago, men paid more for car insurance in 33 states. On average, women paid $10 more than men for their car insurance premiums. However, as recently as 2016, men paid $1 more per year, on average.

The state with the largest gender gap was Nevada, where women paid $121 more per year for car insurance. In 2016, female Nevadans only payed $14 more per year than men. In the 21 states where men pay more for car insurance than women, Wyoming had the biggest gap between the genders, but men only paid $49 more per year than women.

The disparity doesn’t seem to be risk related, as men are more likely to be riskier drivers, especially young men with less than three years of driving experience. “Men typically drive more miles than women and more often engage in risky driving practices including not using safety belts, driving while impaired by alcohol, and speeding. Crashes involving male drivers often are more severe than those involving female drivers,” stated the Insurance Institute for Highway Safety Highway Loss Data Institute. Furthermore, both men and women engage in distracted driving equally.

Six states currently ban the practice of gender-based pricing – Hawaii, Massachusetts, Pennsylvania, North Carolina, Montana, and, most recently, California. California banned the practice just this year, stating “Gender’s relationship to risk of loss no longer appears to be substantial, and the logical justification for the statistical relationship to risk of loss has become suspect.”

The sudden increase in car insurance premiums for women comes without an explanation. “This shift in costs is surprising because, historically, men have paid more than women for car insurance, and most studies point to men as the more dangerous drivers,” said Alyssa Connolly, Director of Market Insights at The Zebra. “So why are women paying more now? Do they exhibit especially risky driving behavior or file more claims? We’re keeping an eye on this issue as consumers, regulators, and insurance companies re-examine whether gender can or should be used in pricing insurance.”

The Zebra study points out that gender-based pricing should benefit women since they are a lower risk. However, this recent jump in gender-based premiums only seems to reinforce that car insurance pricing is as confusing and seemingly arbitrary as ever.

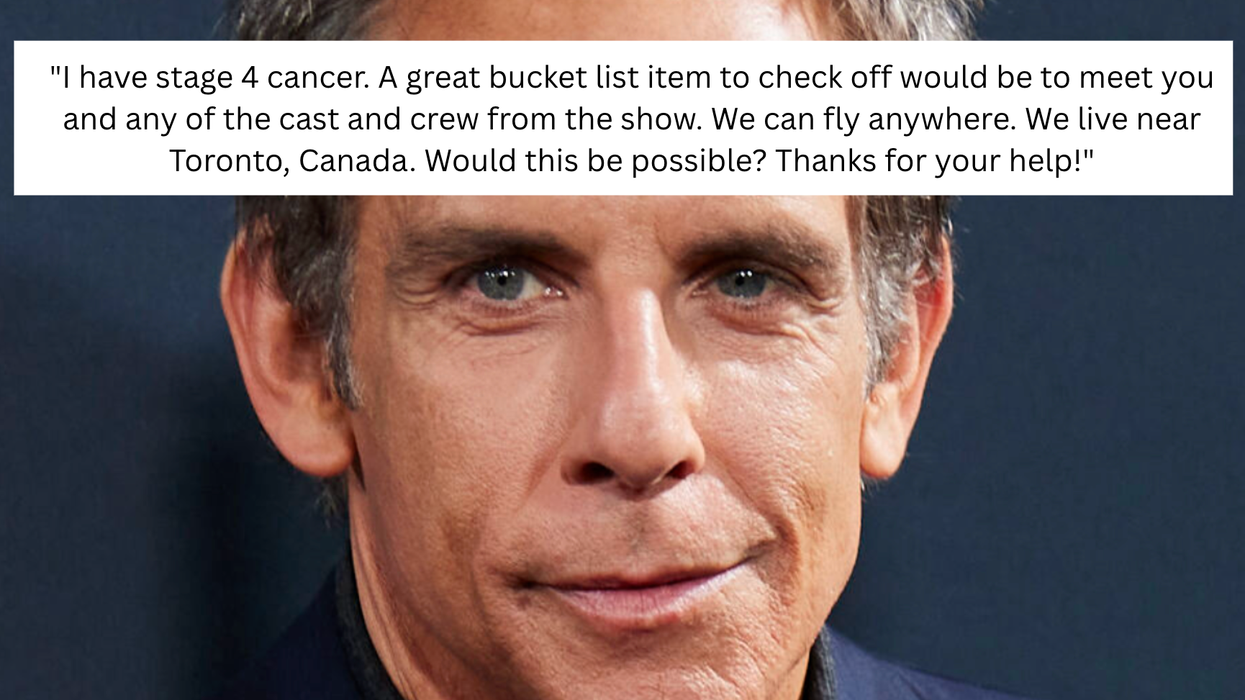

Otis knew before they did.

Otis knew before they did.