The U.S. Justice Department just blocked a $39 billion merger between AT&T and T-Mobile, the 2nd- and 4th-largest telecom companies in the country. The government argues that the move would kill competition between cell service companies without providing enough benefit for the trade-off to make sense. AT&T, which stands to lose billions if the deal fails, is contesting the matter in court. What’s it all mean?

The DOJ is starting to take competition seriously: Deviating from a recent reluctance to challenge corporate mergers, the DOJ asserted itself in this case, perhaps remembering its heritage—in 1984, the government split the original “Ma Bell,” the monopolistic precursor to AT&T, into a dozen smaller companies. Had the merger gone through today, AT&T-Mobile would have controlled a huge chunk of the cell phone market. While the companies argued that this would bring benefits to consumers, the reduction in competition would have put less pressure on the two firms to keep prices low.

So, consumers are probably better off. Some estimates suggested rates could increase as much as 25 percent, without much new innovation or efficiency. “AT&T could obtain substantially the same network enhancements that it claims will come from the transaction if it simply invested in its own network without eliminating a close competitor,” the DOJ wrote. Wicked burn.

AT&T is in trouble. If the deal doesn’t go through, not only will AT&T have wasted months of work by its executives and lawyers, but it could owe T-Mobile’s parent company, Deutsche Telekom, $3 billion. Not to mention that both companies stocks fell after the government blocked the deal, so it was a tough day.

T-Mobile is worse. The also-ran of the major telecoms, T-Mobile lacks the capital to match its competitors' investments in new 4G mobile networks and other technology; its parent company has said it will not provide new dollars for expansions. If AT&T can’t buy the company, it would be surprising if the government allowed Sprint, the other potential suitor, to do so, either. That means either a slow death, or a savior emerging from another industry.

AT&T’s competitors are chill: Sprint, a key opponent of the deal, along with number one player Verizon and regional mobile operators, can breathe a little easier knowing that they won’t be totally outmatched. Sprint already saw its stock rise in the market churn following the announcement.

International travelers get a win. Felix Salmon points out that AT&T and T-Mobile own the bulk of the GSM cellphone market—cell phones that can be used both in the United States and around the world. If AT&T-Mobile were to dominate that market, prices could rise considerably. Globetrotters, breathe a sigh of relief.

Sometimes labor and management have something in common. While vicious battles between unions and management are common in the telecom industry—see the recent strike by Verizon workers—in this case, the Communications Workers of America favored the merger. In spite of the deleterious affect it would have on consumers, the union saw an opportunity to create jobs for its members, including some 5,000 outsourced jobs AT&T promised to return from overseas. They also feared Sprint, which is known for its hostility to labor, snapping up T-Mobile.

Money doesn’t buy everything in Washington. Despite a major lobbying push that garnered bipartisan endorsements on Capitol Hill, support from a major labor union and a collection of NGOs, AT&T was unable to sway the executive branch. There’s still a court battle ahead, but if DOJ holds the line it’s a rare example where serious corporate money couldn’t obtain a company’s desired outcome.

That’s the breakdown.

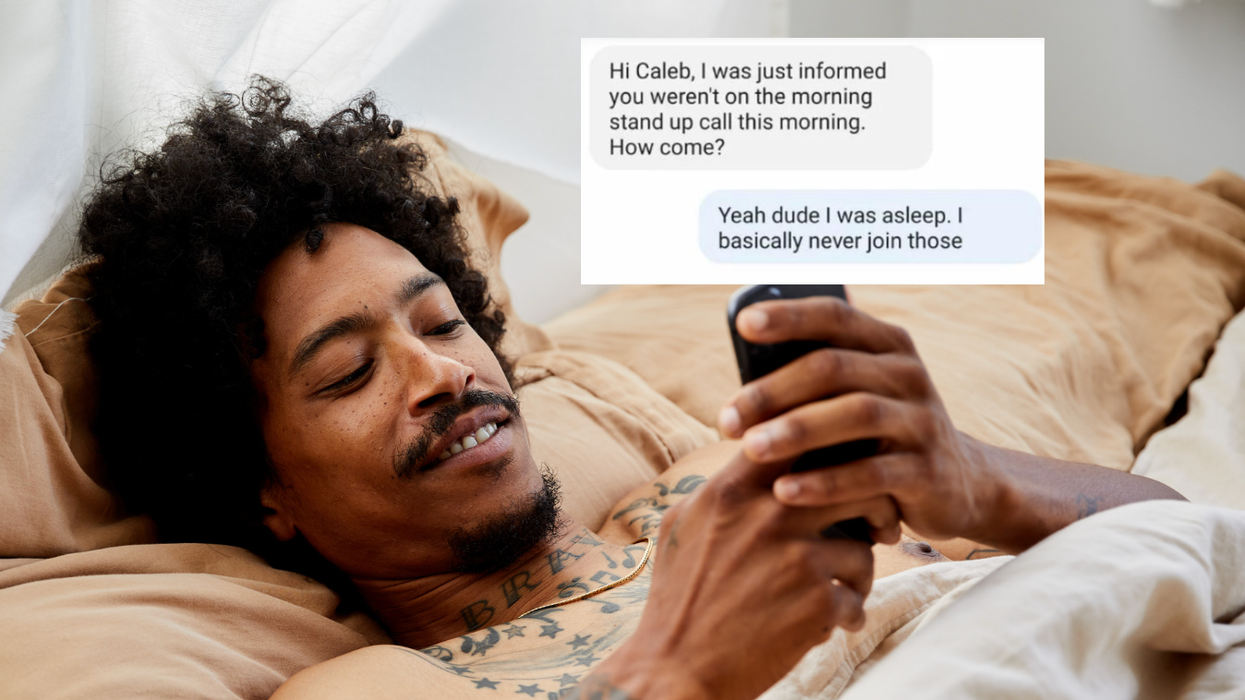

Otis knew before they did.

Otis knew before they did.