Could a mass movement of college students and graduates challenge the student debt status quo? That’s the aim of Occupy Student Debt, a new movement inspired by Occupy Wall Street that wants to send a clear message about the crushing burden of the debt by convincing a million Americans to pledge to stop paying their student loans.

Occupy Student Debt supporters say today's college graduates would "give anything to pay our debt," but they are either unemployed or underemployed because of the recession. President Obama recently fast-tracked debt relief for students set to graduate next year, but his plan doesn’t help someone who’s been out of school for a few years. A lack of consumer protections—particularly for students who borrowed from private lenders—means some of those recent grads are seeing interest rates as high as 25 percent.

Meanwhile, Occupy Student Debt organizers say lenders are "raking in the cash during this time of austerity for everyone else." OSD notes that Sallie Mae’s shareholders received sweet dividend checks in September. “This is the same company that has lobbied so hard to strip away consumer protections from borrowers, leaving students without any bankruptcy protection,” they say.

OSD leaders are also frustrated by seemingly endless tuition hikes. A generation ago, the jewel of public higher education, the prestigious University of California system, was free for state residents. Now, students face skyrocketing costs—tuition is set to rise between 8 and 16 percent every year for the next four to five years, continuing a trend from the past several years. Meanwhile, the UC system is increasingly turning to international students who have the cash to pay non-resident tuition.

Some professors are similarly concerned with the large amounts of debt students are taking on. “The situation is our current students go into debt in order to help pay for our salary and they’re in debt for several decades,” Andrew Ross, a professor of social and cultural analysis at New York University and one of the main organizers of Occupy Student Debt, told Inside Higher Ed.

But refusing to pay student loan bills clearly is not the best option for protesting problems in the industry. Terry Hartle, senior vice president for government and public affairs at the American Council on Education cautions borrowers against jumping on the OSD bandwagon, no matter how frustrated they may be. "The federal government will wreck the borrower’s economic life to get the money back,” he says. Indeed, the consequences for not paying back student loans are severe—wage garnishment, ruined credit ratings, and the potential for being taken to court by the government.

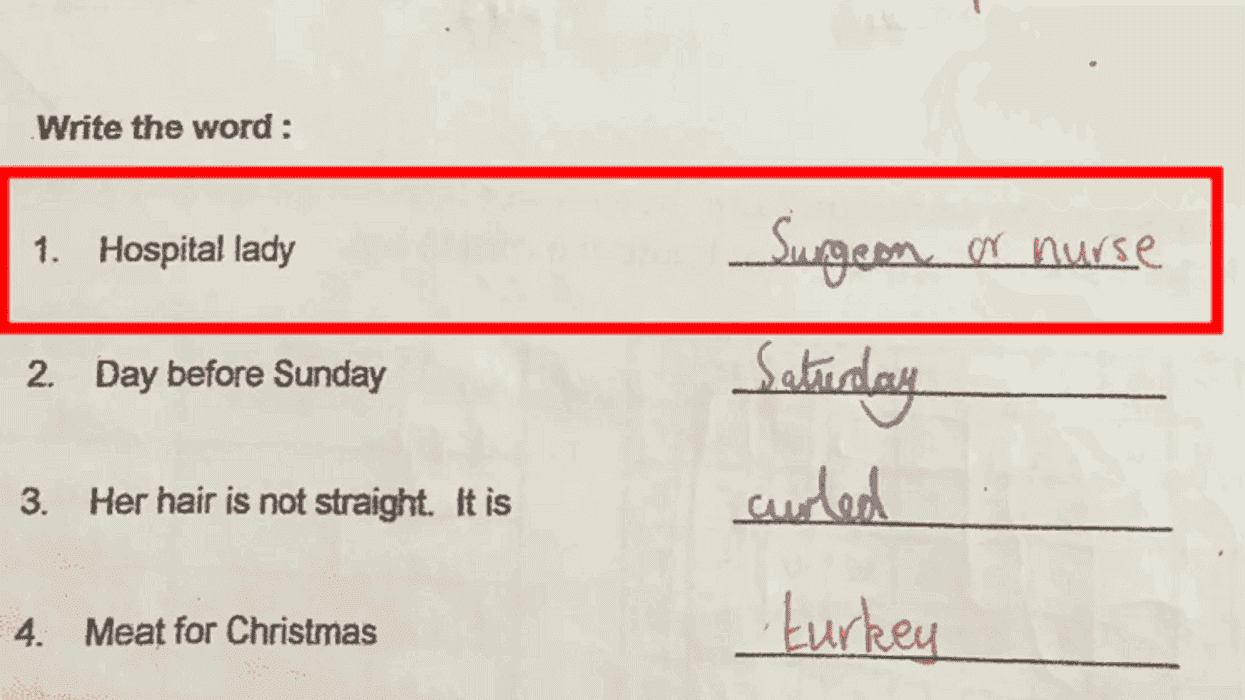

Following the model of the "We are the 99 Percent" Tumblr blog, OSD wants borrowers to submit photos of themselves holding signs describing the status of their student loans—how much they originally borrowed, how much they owe, how much they've paid so far, and the interest rate. Organizers hope that by telling the stories of average Americans, they can tackle the myth that people struggling with student loans just need to pull themselves up by their bootstraps, create a budget, and live within their means.

In one submission, titled "Suckit Sallie," a 25-year-old OSD supporter explains, "I was one of those kids who "was in all the right AP classes, one of 2 or 3 black students on the honor roll, and went to state college @ 17 and had no doubts I would make it in life." Now he lives back at home, owes $1,400 per month, and, after 10 months of job-hunting, can only find a $8-an-hour job at Toys-R-Us. "There is no way I can work enough hours to pay $1,400 a month," the graduate says, explaining that he sees the future as "a dark hole" with "no options, no way out."

The movement's birth and the stories on the blog provide a healthy outlet for the growing disenchantment with the American dream, even if the associated idea of refusing to pay student loan debts is unwise. "We were told to work hard and stay in school, and that it would pay off," the organizers write. "We are not lazy. We are not entitled. We are drowning in debt with few means of escape."

Photo courtesy of Occupy Student Debt

Otis knew before they did.

Otis knew before they did.