Winning a brand new car on The Price is Right might seem like a dream in and of itself for most people. For Michelle Stansbury of San Diego, who did just that playing the “Squeeze Play” game in a March 2016 episode, it was exactly the break she needed to seed fund her dream project as an entrepreneur. She sold her $19,000 worth of prizes for their cash value so she could develop a dating app called TheDateSpot “that helps you get offline faster,” she says. After years of frustration with online dating, she “set about figuring out a way to change how people date online.” She believes her “unique business model” will allow it to become immediately profitable.

Stansbury is one of a growing group of unmarried female entrepreneurs to make the leap to self-employment after a cash windfall, a trend highlighted in two recent studies—one out of Georgia State University and the other from Scottland’s University of Stirling—which discovered single women are more likely to become entrepreneurs than men when extra money comes along—a finding deeply contrary to conventional wisdom and previous scientific research.

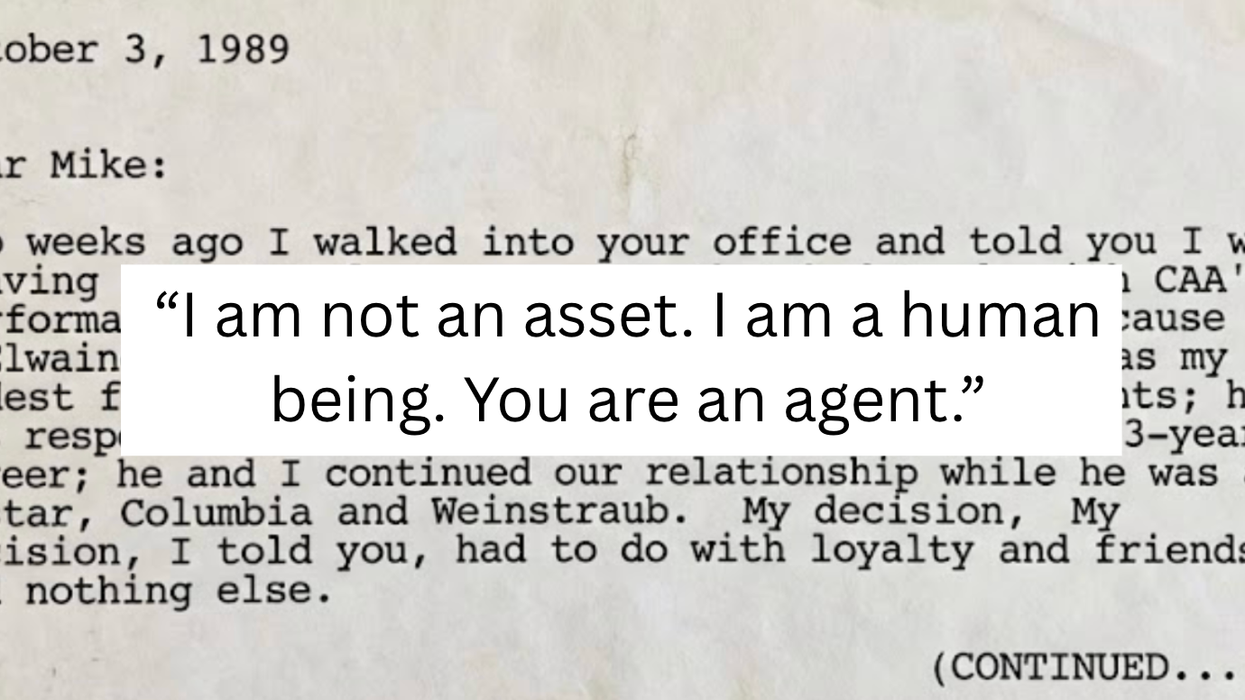

[quote position="full" is_quote="true"]American women weren’t allowed to open a credit card without a husband or a father’s co-signature until 1974.[/quote]

“There’s much evidence out there that women are less ready to bear risk than men. We can go back to evolutionary arguments as to why men and women have different attitudes toward risk, and these attitudes are ingrained within us,” says lead author of the UK study, Tanya Wilson, an early career fellow in the Division of Economics department at Stirling. Women, she says, “don’t like to go and start something (without a net) in case something goes wrong.”

This fear of risk makes a lot of sense, given that for centuries, women were completely dependent upon husbands and fathers for financial support. Even once women became an integral part of the workforce, they weren’t allowed to open a credit card without a husband or a father’s co-signature in the United States until 1974, when Congress passed the Equal Opportunity Credit Act. Today, a working woman earns about $10,800 less per year than a working man (or 79 percent less than what a man makes per hour), according to a report by the congressional Joint Economic Committee. The situation is even worse for women of color, who make as little as 55 cents to the male dollar. All this despite the fact that women have overall higher credit scores, less debt, and fewer late payments than men, according to an Experian study. Perhaps women simply don’t feel they have the financial luxury to take the same risks as their male counterparts—unless, of course, they receive a cash infusion.

“What we’ve seen in the UK over recent years is a huge growth of female entrepreneurs starting up businesses,” says Wilson. “It gives you the freedom to set your own working hours at times that suit yourself and potentially your family.”

Stansbury certainly felt empowered by her windfall. “I feel more comfortable taking on a high-risk, high-reward business venture with the prize money than I would have using my savings,” she says. Without it, she would have had to look for outside investors and share more of her proceeds. “Now, with the wiggle room of being able to bootstrap the app at the beginning, I can bring outside investors later on, retaining a higher percentage of the company.”

Sometimes women are driven toward self-employment out of frustrations with their current employment. Kara Cohen, founder and creative director of Transmitter NYC, a marketing agency, was tired of the “male-dominated industry” she worked in. “I worked my butt off for years and did not feel like that was acknowledged, while people above me were getting better compensation and more credit.” Tired of this “broken system,” she wanted to find a way to work that was more cost efficient for her clients and more meaningful to her. She left her job at a marketing agency six months ago to start Transmitter NYC.

[quote position="full" is_quote="true"]I worked my butt off for years ... while people above me were getting better compensation and more credit.[/quote]

To get to that point, every time she got a raise, she saved the difference, living on the same income, with the goal of saving up a six-month net of cash before she leaped. However, dissatisfaction with the job made her leave sooner than that. Luckily, she says, “I was able to start bringing in clients and money immediately.”

As a result, Cohen reports being much happier. “I feel that I’m actually helping people that I hire. Before I felt like I was part of this system to get money out of them, and now people come to me asking for help.”

If given the choice to do it again, Cohen says, “I absolutely would choose this path, even if I never make as much money as I would have.”

Otis knew before they did.

Otis knew before they did.