Inheritance has been a major point of discussion for centuries. After a family is done grieving the loss of a loved one, the big question that is left is "Who gets what?" especially if there's no will. If a person has a fixed will it is easier to settle everything. But what does one do to stop unnecessary fights if there's no will present in the first place? Solicitor Paul Britton explains what happens to a person's inheritance if they don't make a will in an interview with Independent UK. From how money is managed for a married person with children, an unmarried person, or a person with no one to inherit their money he breaks down every aspect of inheritance without a will.

Britton explains that if a married person dies without a will, the inheritance goes to their spouse. At least 322,000 pounds. The rest is equally divided between the spouse and the person's children. With each child getting an equal amount from their inheritance. The solicitor further explained that things get more complicated if the person doesn't have a partner or children. He adds that the money still follows the bloodline though. The inheritance will now either go to the person's grandchildren or go up the bloodline to their mom and dad or grandparents. However, if there's no one to inherit the person's money then the money goes to the crown. Hence, if you have no living relatives or a will, your money, possessions, and property will belong to the government or the crown.

As per Equifax UK if a person has a legally binding will, the processes following the execution are quite simple with named parties to ensure that the will is followed properly. But if you die intestate, the law decides what would be done with your inheritance. The law states that romantic partners, friends, and business partners will not be included in the division of the inheritance if the family members do not consent to giving it to them in case of no will. The family will also not have a say in how the assets are split among themselves, it will solely be carried out based on the law in the UK. It is important to note that various details vary based on the country and the region you live in. The rules of inheritance in Scotland and Ireland are quite different from those in the UK.

If you are married or even separated without being divorced a major chunk of inheritance will go to your spouse if not all of it as per the source. Except in Scotland, your children might get nothing. If you have a partner whom you are not legally married to and you don't have any children your possessions will go to your parents. However, if you are not married and have children and one or more living parents your estate will be equally divided between your children and their children. In Ireland, the division is much more complex as the estate can also be handed over to nieces and nephews if there are no close living relatives. This makes it essential to draw up a will to avoid complexities.

A symbol for organ donation.Image via

A symbol for organ donation.Image via  A line of people.Image via

A line of people.Image via  "You get a second chance."

"You get a second chance."

36 is the magic number.

36 is the magic number. According to one respondendant things "feel more in place".

According to one respondendant things "feel more in place".

Some plastic containers.Representational Image Source: Pexels I Photo by Nataliya Vaitkevich

Some plastic containers.Representational Image Source: Pexels I Photo by Nataliya Vaitkevich Man with a plastic container.Representative Image Source: Pexels | Kampus Production

Man with a plastic container.Representative Image Source: Pexels | Kampus Production

Canva

Canva It's easy to let little things go undone. Canva

It's easy to let little things go undone. Canva

Photo by

Photo by

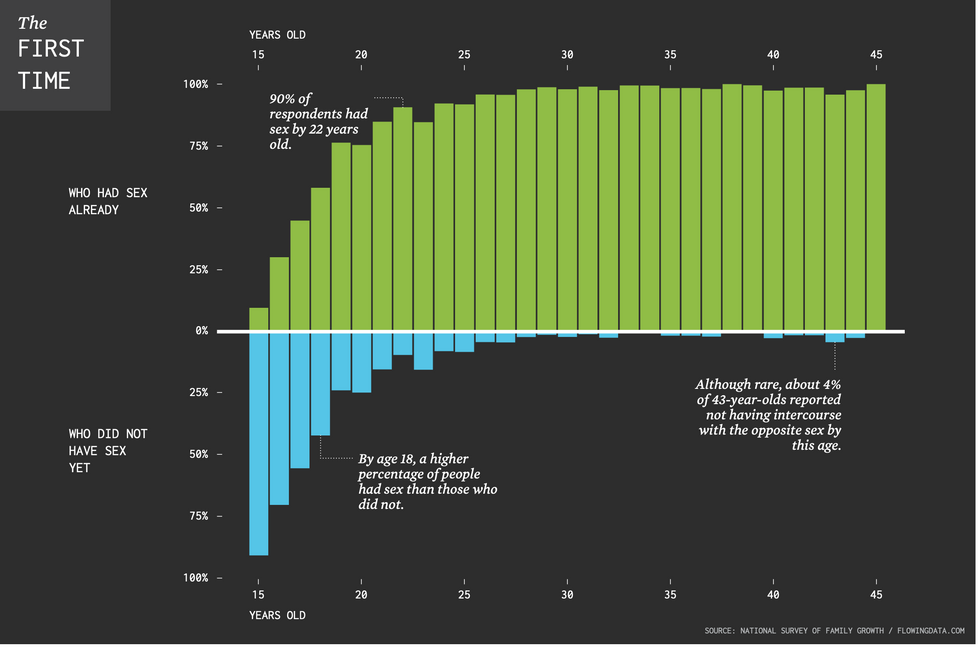

Teens are waiting longer than at any point in the survey’s history. Canva

Teens are waiting longer than at any point in the survey’s history. Canva Chart on the age of a person’s first time having sex.National Survey of Family Growth/flowing data.com | Chart on the age of a person’s first time having sex.

Chart on the age of a person’s first time having sex.National Survey of Family Growth/flowing data.com | Chart on the age of a person’s first time having sex.