Even in the rough-and-tumble theater of American politics, the idea of "baby bonds" enjoyed a short time in the spotlight. On the campaign trail, Hillary Clinton casually endorsed the $20-billion-a-year concept of giving a $5,000 bond to every child born in America-money that, after accruing interest, could be put toward college, a home loan, or a business when the child turns 18. Conservatives pounced, reveling in the opportunity to label Clinton another spendthrift Democrat, and when Clinton released her economic agenda a few weeks later, the idea was nowhere to be found.But baby bonds deserve a fair hearing. Supporters point to our nonexistent savings rate. Young Americans-particularly poor young Americans-have little ownership stake in society: They have few assets and nothing to build upon. The miracle of compounded interest could turn a $5,000 bond into $20,000 over 18 years (God knows what college will cost in 18 years, but every little bit will count). And for those who fret over a government giveaway, use of the bond could be tied to national service of some kind, be it AmeriCorps or the National Guard. Our last major policy experiment of this sort didn't fare too badly: The GI Bill, passed in 1944, cost taxpayers $5.5 billion (about $60 billion in today's dollars), but the legislation ushered millions of Americans into college and triggered one of the largest economic booms in our nation's history.

Search

Latest Stories

Start your day right!

Get latest updates and insights delivered to your inbox.

We have a small favor to ask of you

Facebook is critical to our success and we could use your help. It will only take a few clicks on your device. But it would mean the world to us.

Here’s the link . Once there, hit the Follow button. Hit the Follow button again and choose Favorites. That’s it!

The Latest

Most Popular

Sign Up for

The Daily GOOD!

Get our free newsletter delivered to your inbox

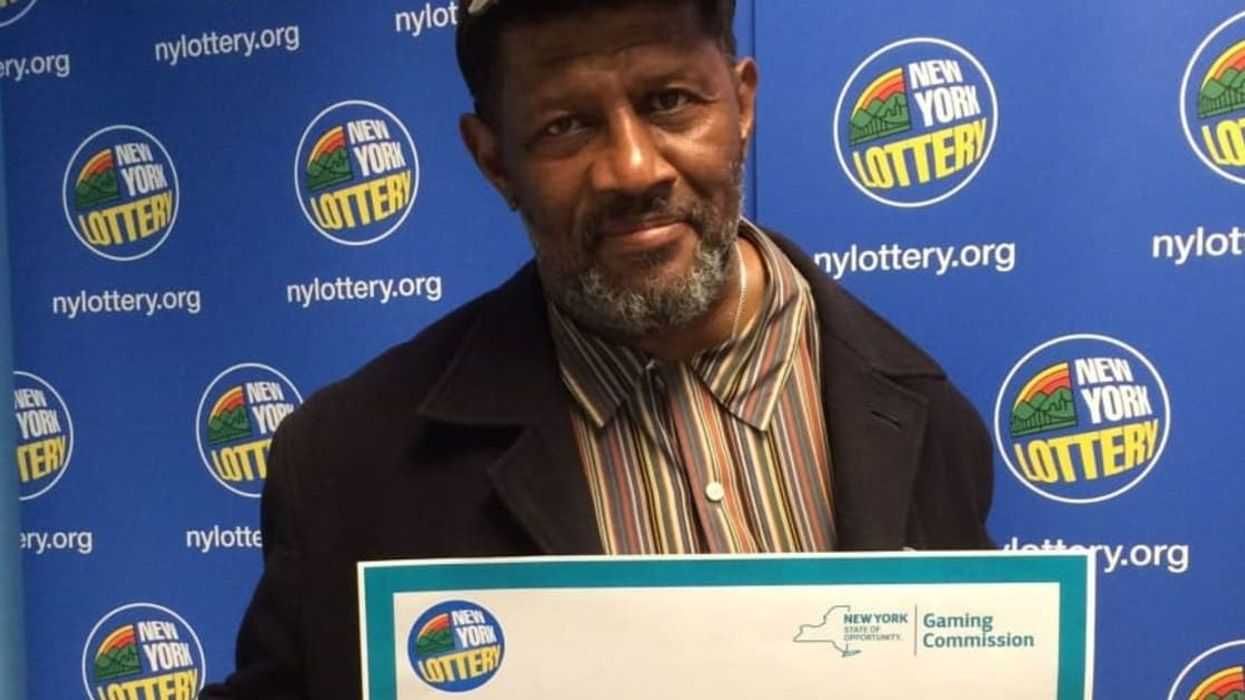

Otis knew before they did.

Otis knew before they did.