What’s going on with the economy right now?

The stock markets have been crumbling, consumer confidence flagging, and today’s unemployment report shows that the economy is barely creating enough jobs to keep up with the country’s expanding population, much less reduce unemployment from an untenably high 9.1 percent.

All this is coming despite a last-minute deal in Washington to prevent the U.S. from defaulting on its debts, which was expected to be at least a temporary salve on our economy. But that political battle wasn’t about our real problems at home, or around the world—and guess what? It didn’t solve them.

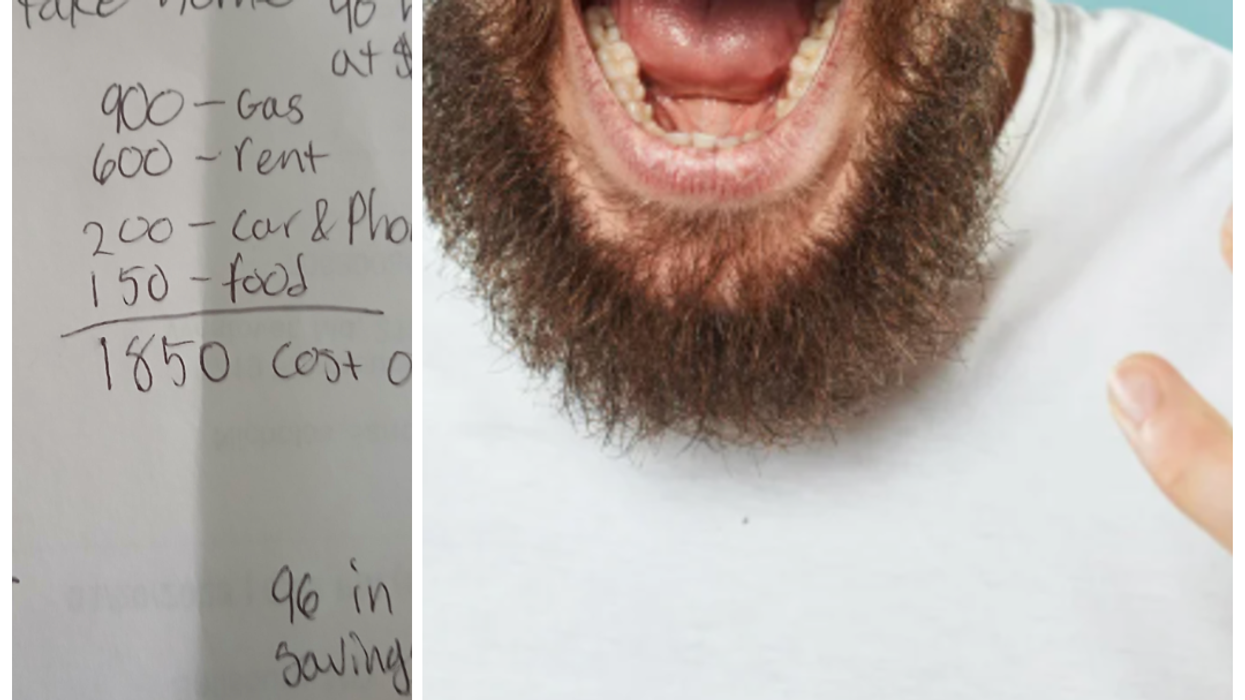

The real problem is deceptively simple: We’re not making, buying, or selling enough stuff. People are still focused on paying off their mortgages and credit card bills to spend money at businesses the way they used to, and businesses are reluctant to hire or increase wages until sales go up.

As soon as the budget focus and fears of a U.S. debt disaster passed, investors realized that economic growth in the United States is flagging by nearly every measure, from manufacturing indexes to consumer spending. On Thursday, they panicked, and the DOW industrial average dropped 500 points.

As if to underscore the futility of the Washington debt panic, U.S. government bonds rallied as investors bought them as a safe haven. Of course, if you don’t own stock or aren’t cashing in your 401(k) anytime soon and you have a job, this may seem academic. But high unemployment and plunging stock markets aren’t just things that happen to other people, they’re warning signs that we’re edging back toward a recession at an alarming pace.

While 2010 saw growth increase at a relatively healthy clip, thanks to increased federal spending and action by the Federal Reserve, those supports have been pulled back. Without them, consumers and companies haven’t been able to break out of a vicious cycle of slow growth.

Even that might not have been enough to halt recovery, but it doesn’t help that across the Atlantic, Europeans are dealing with an actual debt crisis—or rather, not dealing with it, as a series of stopgap solutions negotiated by leaders like German Chancellor Angela Merkel and French President Nicolas Sarkozy have failed to convince anyone they’re willing to face up to the actual budget problems in Greece, Italy, Portugal, and Spain. This will have repercussions in the United States because the European Union is our largest trading and financial partner.

That’s not to say a double-dip—the fear that we escaped the Great Recession only temporarily before descending into another economic decline—is inevitable.

Some economists are calling Thursday's slump a stock-market correction. We haven’t seen a plunge like we did just a few years ago at the outset of the Great Recession. This revision might even offer some benefits: Reuters columnist Felix Salmon writes that this might be a good time to buy cheap stock.

Another sign of hope is that now that lawmakers have kicked the can down the road on fiscal questions, they might take the time to pass a few basic expansion measures, like extending unemployment insurance so that folks without jobs can still get by (and spend money).

More importantly, the ever-cautious Fed Chairman Ben Bernanke might take some action to pump more money into the economy and allow inflation to reduce debts at the central bank’s meeting next week.

In the meantime, our three-year odyssey of economic ugliness is far from over.

Photo (cc) via Flickr user pingnews.com