Michael Lewis, the author of the Wall St. narrative Liar's Poker, has an exhaustive exploration of the forces behind the current financial mess. This essay isn't for the faint of heart-it's full of death knells and damnation-but it offers a pretty definitive take on how things got this bad. Lewis spends some time discussing, "a handful of people [who] had been inside the black box, understood how it worked, and bet on it blowing up," one of whom is Steve Eisman. Here's a description of Eisman's entrance into the subprime mortgage world back in 1991: One of Oppenheimer's investment bankers stomped around the research department looking for anyone who knew anything about the mortgage business. Recalls [Steve] Eisman: "I'm a junior analyst and just trying to figure out which end is up, but I told him that as a lawyer I'd worked on a deal for the Money Store." He was promptly appointed the lead analyst for Ames Financial. "What I didn't tell him was that my job had been to proofread the documents and that I hadn't understood a word of the fucking things."Later, Lewis discusses how preposterous things got by the early to mid aughts, especially in California;The loans would have been made by one of the more dubious mortgage lenders; Long Beach Financial, wholly owned by Washington Mutual, was a great example. Long Beach Financial was moving money out the door as fast as it could, few questions asked, in loans built to self-destruct. It specialized in asking homeowners with bad credit and no proof of income to put no money down and defer interest payments for as long as possible. In Bakersfield, California, a Mexican strawberry picker with an income of $14,000 and no English was lent every penny he needed to buy a house for $720,000.The takeaway here isn't new, but the probing, narrative excellence helps put everything in context. Link to Portfolio.

Search

Latest Stories

Start your day right!

Get latest updates and insights delivered to your inbox.

We have a small favor to ask of you

Facebook is critical to our success and we could use your help. It will only take a few clicks on your device. But it would mean the world to us.

Here’s the link . Once there, hit the Follow button. Hit the Follow button again and choose Favorites. That’s it!

The Latest

Most Popular

Sign Up for

The Daily GOOD!

Get our free newsletter delivered to your inbox

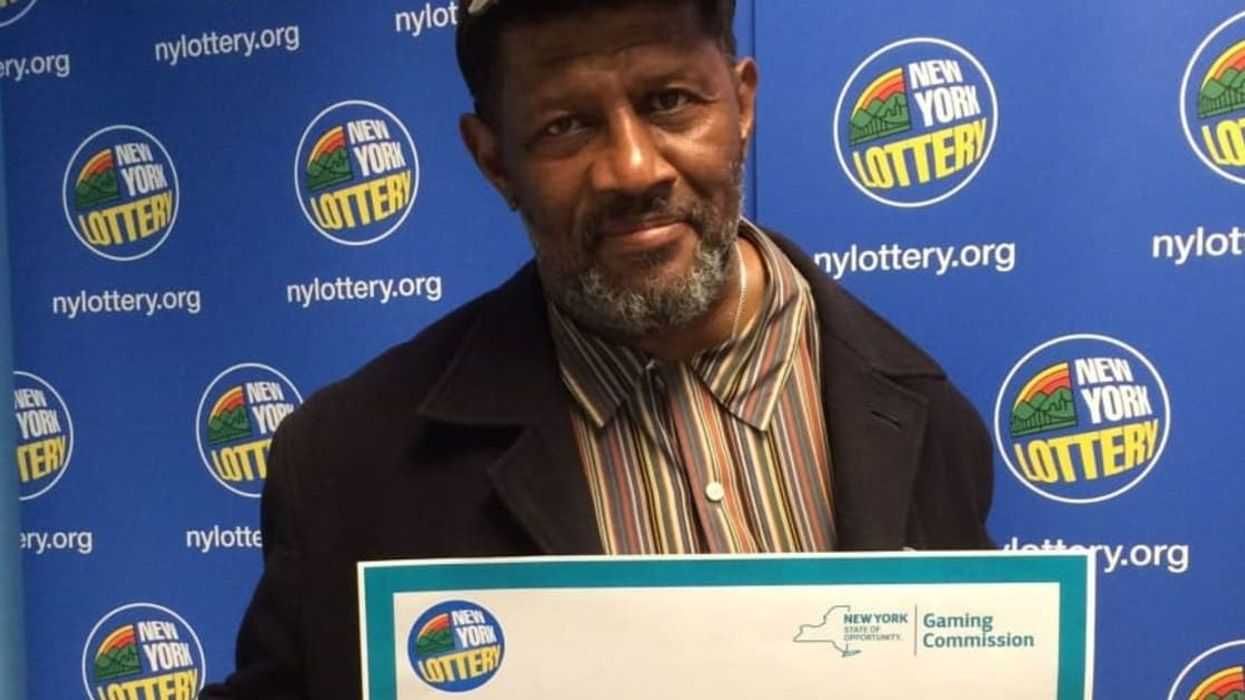

Otis knew before they did.

Otis knew before they did.