Despite what the cost of living from city to city across the United States might suggest, $25 can still go a long way. Over the last decade, more than two million people have secured funding for their small business ideas and community enrichment loans through the collaborative efforts of Kiva, in partnership with PayPal. That equates to a new loan being funded every two minutes, with more than $920 million lent as of this writing. Launched in 2005, the microfinance nonprofit developed a crowdfunding platform that connects people in 80 countries around the world. Since then, the two organizations have been in lock step facilitating small loans that have big impact. From textile makers to bakers, here are 25 ways you can spend $25 around the world, get repaid and lend again on Kiva.org.

Help a Refugee Start Over

1. Whether helping someone secure a working visa or start a new business in their home, $25 goes a long way in supporting refugees and internally displaced people looking to rebuild their lives.

2. For those in conflict zones around the world, survival could simply mean being able to pay for food for the family. For these borrowers, day-to-day funds are just as important as financing for business ventures.

Single Parents Turned Entrepreneurs

3. All around the world, parenting is a full time job for both women and men. Even more for those that go it alone. While these single parents work to keep food on the table, they’re also local small business owners in their communities.

Local Fare in Global Communities

4. In Rwanda, 28-year-old Emmanuel is a married father of three and a local sodamaker in his community. He is looking to grow his business and you can help rebuild the Rwanda economy by supporting one of its many entrepreneurs. Loan Amount: $1250

5. 24-year-old Adel wants to make and sell his own desserts in Ramallah, Palestine. He is looking to purchase the machine needed to make his treats so that he can earn an income and ultimately some day get married. Loan Amount: $1500

6. Historically, Pacific women have not had access to property, credit, and equal opportunity, according to a recent report by the International Finance Corporation at the World Bank Group. For these women located throughout Samoa, food items, machinery and tools will help bring financial inclusion to communities oftentimes excluded.

7. In Baltimore, Maryland, demand is growing for Cafe Los Suenos coffee. The specialty coffee roaster is co-founded by Carlos Payes, who grew up near Santa Ana, El Salvador and worked in the coffee fields there as a young boy. Loan Amount: $10,000

8. Named after the co-owners’ dog John P. Sullivan, The Three Legged Dog Public House in Independence, Oregon promotes a small town, friendly atmosphere while serving specialties such as home-made sauces and hand-crafted bitters. John needs to fund operations and further expand the restaurant’s footprint as well as its impact on the local community. Loan Amount: $10,000

9. Berries by Quicha is the result of Laquicha’s passion for creating items outside-of-the-box and cooking for her family. Her sweet treats are handcrafted in Maryland where she is looking to expand sales. Loan amount: $10,000

10. Maria Cecilia is a rice farmer turned restaurateur in the Philippines looking to purchase new utensils and ingredients to expand her menu. Loan amount: $1,100

From Farmer to Table, Grocery Stores, and More

11. Since the late 19th century, Ghana has been one of the world’s leading producers of cocoa. Today, farmers in Accra are part of a network of Ghanaian cocoa farmers, who help the country maintain its position as the world’s second-largest producer. Amid a changing climate and an increasing need to be more connected to the cocoa world, Farmerline is working to equip millions of farmers with the tools and tips necessary to boost productivity and yield to result in better income. A $50,000 loan will provide 500 cocoa farmers with weather, farming information and financing through mobile services.

12. In Nairobi, Kenya, coffee farmers producing high-quality coffee earn less than 35% of market value for their beans due to lack of market access and knowledge of the quality of their product. Vava Coffee, the Fairtrade-certified social enterprise is working to link smallholder coffee farmers to markets in search of sustainable, ethically sourced coffee. Loan Amount: $50,000

13. Cirila plants potatoes, carrots and corn on her plot of land in Peru. A member of the San Cristobal De Aparquilla Group, Cirila is looking to purchase seeds and fertilizers to expand her agriculture business. Loan Amount: $6,350

14. The Abunzubumwe Cb Group in Rwanda, led by 33-year-old Jacqueline is a group of “United People” looking to improve their standard of living. Jacqueline would like to purchase more mangoes, pineapples, and oranges to sell in her community in order to renovate her home. Loan Amount: $7,825

15. The Margaritas De Macamaca Group in Bolivia is made up of eight micro-business women who are looking to plant new seeds and increase production of their potatoes for sale. Loan Amount: $5,200

16. 36-year-old Margoth is exploring beekeeping as a new business opportunity to secure more income and better support her family. Loan Amount: $4,925

An Education in Learning Funds

17. All around the world, students from all walks of life are looking for ways to fund their education. From tuition fees to school supplies, these borrowers are working toward a better future through education.

From Wool to Riches

18. In La Paz, Bolivia, Señora Estela runs her own business selling wool. Borrowing from her mother’s business sense, Estela is looking to grow her wool sales and build her own storefront with a $5,275 loan.

A Local Artist Movement

19. Mauricio is selling natural beads sourced from the rainforests of South America to artists to create non-traditional pieces of jewelry. He is looking to expand his beads and build a website to promote his business. Loan Amount: $7,000

20. Arte a Palo is a New York-based, Latin America-inspired craft shop selling woodwork, acrylic, glass and resin creations by local artists, all made from recycled and repurposed materials. Loan amount: $10,000

The Life Savers

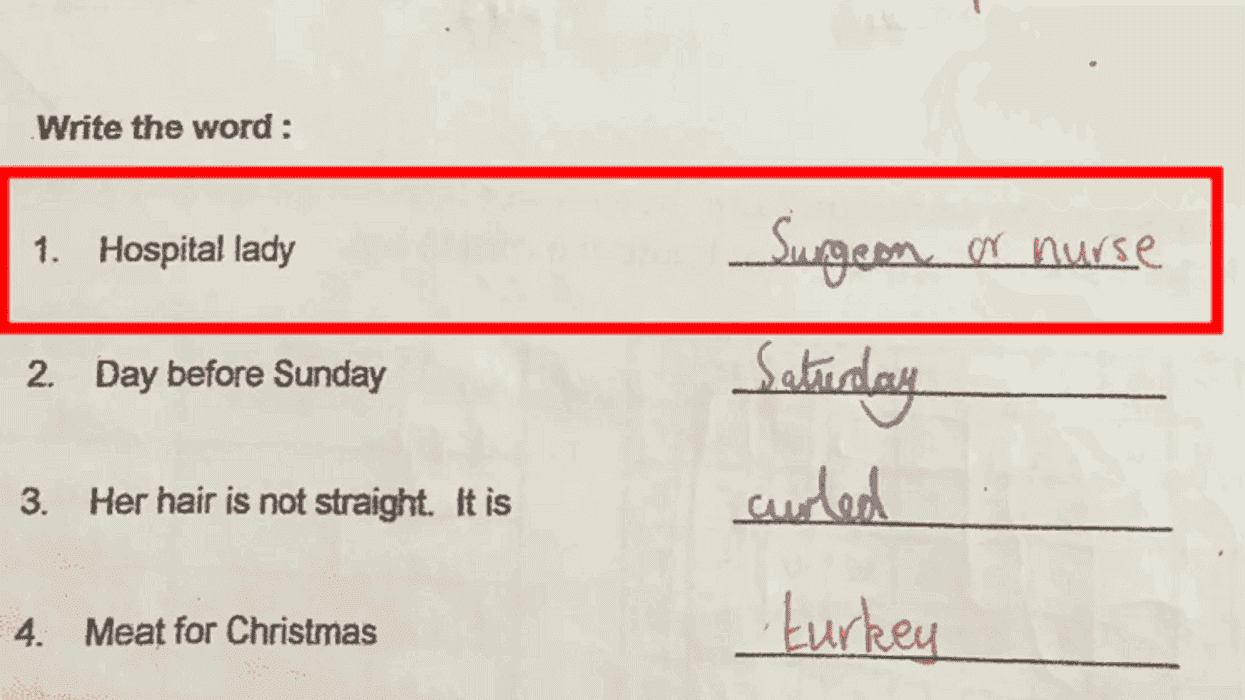

21. From medicines to surgeries, $25 could help save a life on the other side of the world.

22. In Palestine, families use gasoline to heat water which is often dangerous, expensive and inefficient. Hazem is looking to purchase a solar water-heating system for the home he shares with his wife and three children. Loan Amount: $2,000

Equal Opportunity for Men, Women and Children

23. In remote communities around the world, distance from major cities often times means a lack of access to an economic center. These borrowers run their own local businesses and farms.

24. Despite 81% of Kiva borrowers being women, these men are requesting funds for everything ranging from school fees to carpentry tools.

25. Perhaps the clearest example of the ripple effect created by equal opportunity to financial security, women on average reinvest 80% of their income in the wellbeing of their children. All around the world they’re starting businesses, going to school for the first time and building their communities by focusing on strengthening their families.

Top photo: One of Kiva’s borrowers with her son in Honduras.

This article is part of our series celebrating 10 years of collaboration between PayPal and Kiva. Help kick off the next decade of impact. Make a loan today at Kiva.org and the first 10,000 lenders through 10/10/16 will receive a $25 Kiva credit, provided by PayPal, to lend again. Terms and conditions apply.

Otis knew before they did.

Otis knew before they did.