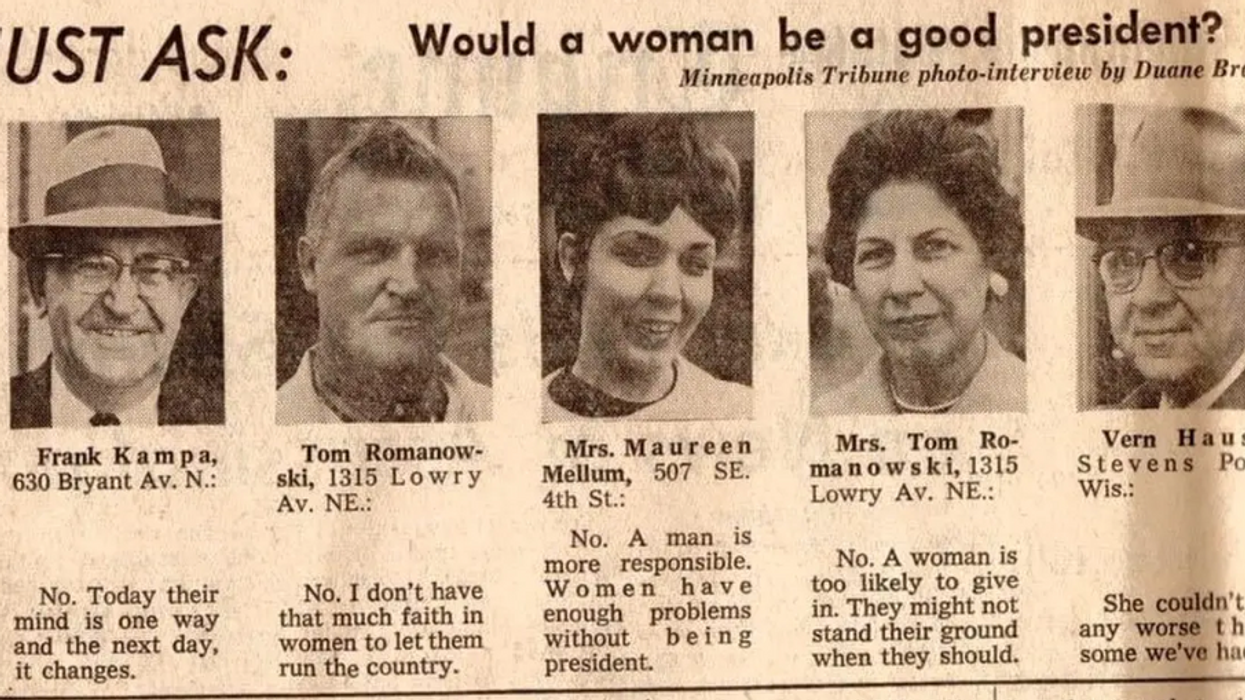

Harry Truman once wished for one-handed economists, so that they could never say "on the other hand." So, while my colleague gleefully combs through the bill for the millions to be spent, while the bill was passed by most of the House Democrats and none of the House Republicans last night, and while jobless claims hit an all-time high, there are a lot of people, including a lot of smart economists, who think this stimulus package isn't going to fix anything. Let's have a look at what they're saying (I credit the good folks over at The Corner for compiling many of these; I am not so up on my conservative economists):Republican Senator Jim DeMint has made an alternative stimulus proposal that involves across-the-board tax cuts, the argument being that the stimulus bill gives a lot of money to places that may not use it to create jobs, but if everyone has more money in their pocket, they will spend more, thus stimulating the economy.Robert Murphy argues that by propping up failing businessses, we are merely denying the root causes of the recession: that our economy was out of wack, and this is a necessary but painful correction that government spending will only delay, but not fix:"On a physical, macro level, raw materials and workers need to be reshuffled away from sectors such as housing and financial services, and into other areas that were stretched thin during the boom years. This period of retrenchment and readjustment is painful-they call it a recession. But it is necessary to recalibrate the economy's complex structure of production after it was so distorted during the boom.Government efforts to prop up consumption spending hamper the true recovery process. The unsound enterprises started during the artificial boom years need to be liquidated so their resources and workers can be redeployed to better uses. By doing everything in its power to stall this painful readjustment, the government simply prolongs the slump."This piece argues that the trade protectionism in the bill (projects must use only U.S.-made steel, for example) will hurt the worldwide economy, hurting the United States in the long run. Remember Smoot-Hawley? Probably a good thing to brush up on these days.This piece from the Heritage Foundation breaks down how much each of us has to pay for the stimulus bill. Remember that the government is paying for this, and the government's money is your money, so you are paying this. That's a bit reductive, sure, but it's not untrue. The hope being that by boosting the economy, the government will have more money than it needs at the time when it needs to ask for this money back from us. However, should that not happen, the Heritage Foundation has found that:"$825 billion is worth approximately $10,520 for each family in the United States, or $22,445 for each family with children under the age of 18. These figures account for a large portion of what families spend money on each year, including food, clothing, shelter, and health care."Their proposal? Lower taxes. Republicans want lower taxes; Democrats want more government spending. And never the two shall meet, it seems. This Cato piece also argues that the problem is that people are merely discovering that the last eight years were a fluke, and the recession is merely the economy going back to normal after a period of artificial inflation:"Most economists, government officials and politicians continue to believe the standard Keynesian explanation for recessions: Recessions are caused by consumers and firms becoming "spooked" for no meaningful reason, so consumption and investment spending falls below normal levels. This reduces demand for goods and services, which reduces employment, which reduces spending even further, and so on. Since the level of spending before the "spooking" was presumed to be sustainable, the solution to the problem is simple: Increase spending to where it had been during the boom.In reality, excessive money growth drove asset prices up and drove interest rates down, making people feel richer than they really were and lowering the cost of borrowing money to facilitate more spending. Since the level of spending before the period of excessive money growth was just sustainable, the resulting level of consumption and business investment spending was unsustainable. The solution is to allow asset prices to fall to levels that accurately reflect what our economy can produce. This will make it clear to people that they are not as rich as they thought two years ago and thereby return spending to sustainable levels."And there you have it. In my mind, economics seems to be a mostly made-up "science," and I am pretty sure nothing the government does will have as much effect as other events (see: Great Depression and World War II, for instance). That said, doing nothing (or just lowering taxes) does not really seem like a viable move for a government, politically if not also economically. So, if we can get another round of the equivalent of WPA posters and CCC National Park trails out of this, maybe that's all we need until whatever is really going to cure the recession comes along. But, in the meantime, it's important to look at all sides.Image via.

Search

Latest Stories

Start your day right!

Get latest updates and insights delivered to your inbox.

We have a small favor to ask of you

Facebook is critical to our success and we could use your help. It will only take a few clicks on your device. But it would mean the world to us.

Here’s the link . Once there, hit the Follow button. Hit the Follow button again and choose Favorites. That’s it!

The Latest

Most Popular

Sign Up for

The Daily GOOD!

Get our free newsletter delivered to your inbox

Otis knew before they did.

Otis knew before they did.