There's lots of blame to go around for what happened to the U.S. economy in 2007, 2008, and beyond, but let's turn just for a moment to 2013. The New York Times blog Economix featured a post today on a "bipartisan" effort to, well, let's let writer Simon Johnson describe it:

[...] to push strongly for the rollback of important parts of the Dodd-Frank legislation.

First, the white paper frames the entire issue in a way that is incorrect—but highly informative about the attitudes at work: "Evaluating financial regulatory reform requires consideration of the inevitable trade-off between market stability and the combination of innovation, risk-taking and growth."

There is no such trade-off. Financial crises destroy growth—and for a long period of time. If you want to undermine American productivity, as well as the power and prestige of the United States, step back and allow the financial sector to go crazy again. In the last decade, the United States lost its stability and its growth. It’s too bad the presidential candidates were not pressed on this point during the recent debates, and particularly on the cost of the crisis, estimated by Better Markets to be more than $12.8 trillion.

That's a really important point. Regulation can reduce risk and reward, but it should specifically be reducing the risk to taxpayers and rewards to those who exploit them. It's amazing that, so soon after Wall Street greed and Washington naivete (or worse) sucker-punched taxpayers, there's a quiet effort to make it easier to do again. A "bipartisan" effort.

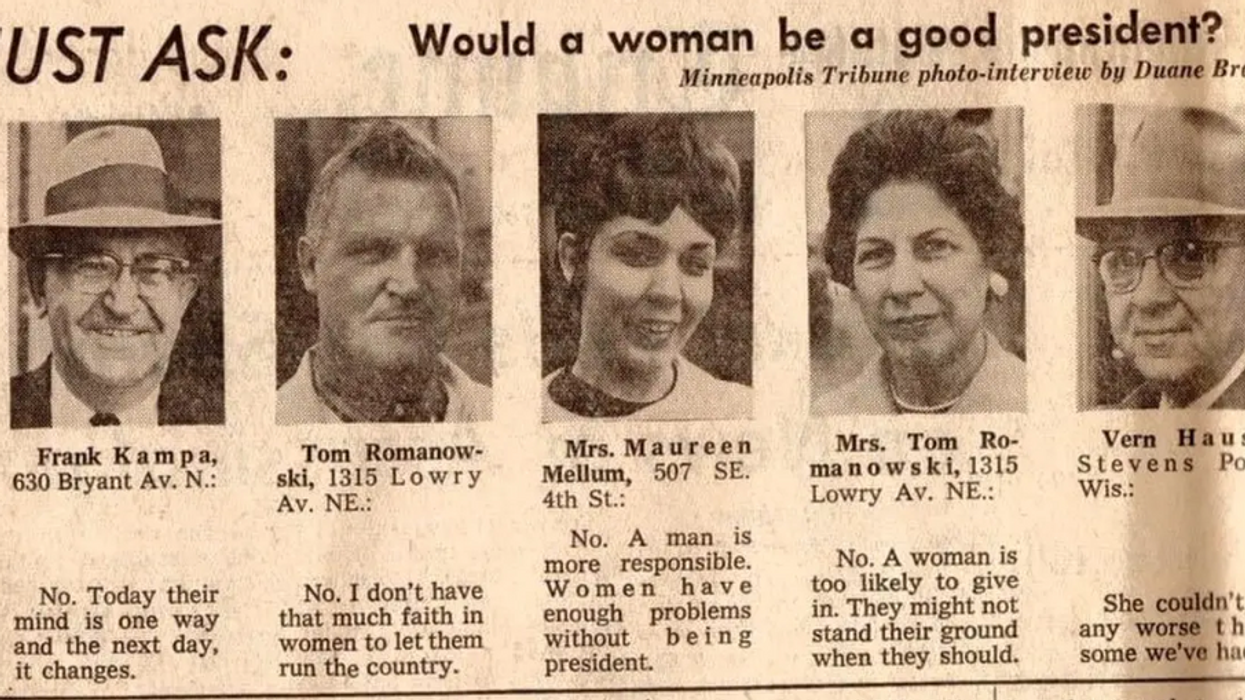

Photo via Wikimedia Commons.

Otis knew before they did.

Otis knew before they did.