If junk foods are major contributing factors to obesity, what will it take to discourage their consumption?

A punitive tax might work—in much the same way that tobacco taxes discouraged smoking—but in one recent study, published in the Journal of Consumer Affairs, Canadian researchers suggest that taxes might work better when there's a warning label explaining the reasons behind them.

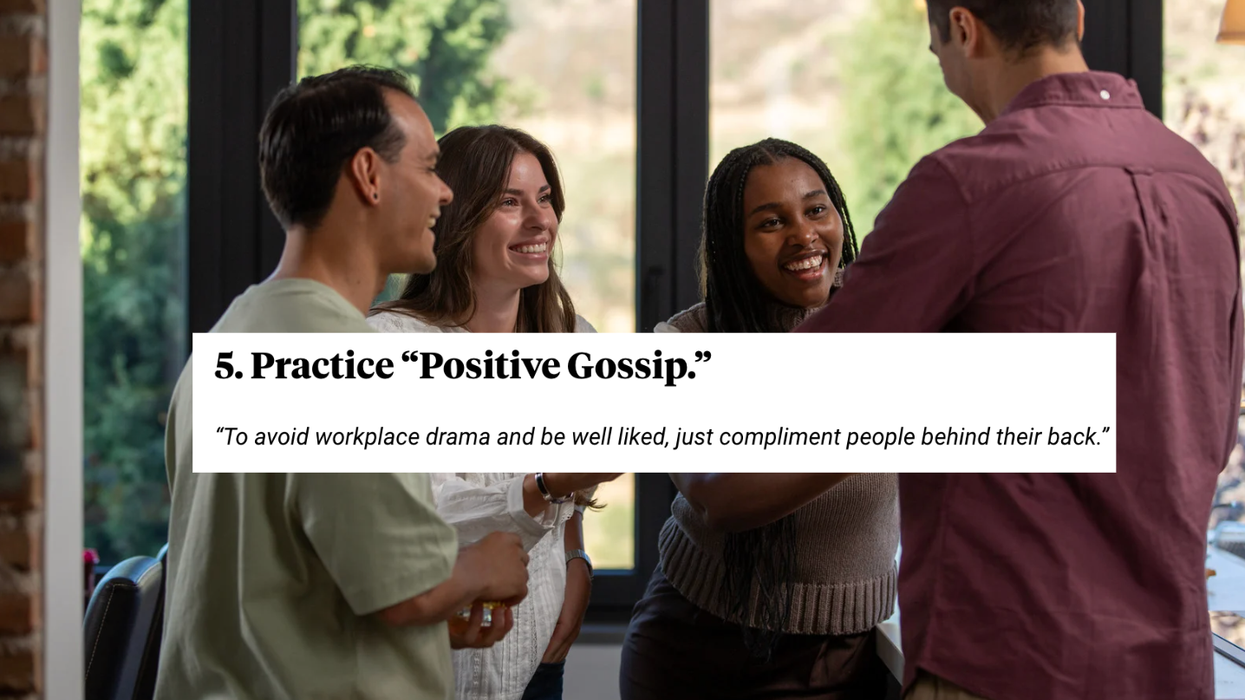

In a random survey, 364 grocery store shoppers were asked to choose between two relatively inexpensive snacks: a high-fat one and a healthier option. Some came with the hypothetical warning label (above). What the researchers found was that some consumers already avoided unhealthy snacks, either because of the price or because of perceived effects. But another group—those shoppers with the highest body weight—seemed to be deterred only when unhealthy foods came with a warning label.

The study adds to the argument that the best way to combat obesity should be legislation that discourages behaviors and products that are unhealthy for all of us—even if it disproportionately benefits those who need it most.

Others suggest taking any revenue collected from a fat tax and using it to subsidize the purchase of healthier foods. As Travis Saunders points out on the excellent blog, Obesity Panacea, one recent study suggests that those kinds of price manipulations could have unintended consequences.

For example, if health foods are subsidized, it is likely that people will buy more of them, which seems like a good thing. But it is also very possible that people may use the money they save on subsidized health foods to buy even more junk food.

So, what do you think, do the potential benefits of warning labels outweigh the risks?

Label via "Heterogeneous Consumer Responses to Snack Food Taxes and Warning Labels," 2011.

Otis knew before they did.

Otis knew before they did.