Search

Latest Stories

Start your day right!

Get latest updates and insights delivered to your inbox.

We have a small favor to ask of you

Facebook is critical to our success and we could use your help. It will only take a few clicks on your device. But it would mean the world to us.

Here’s the link . Once there, hit the Follow button. Hit the Follow button again and choose Favorites. That’s it!

The Latest

Most Popular

Sign Up for

The Daily GOOD!

Get our free newsletter delivered to your inbox

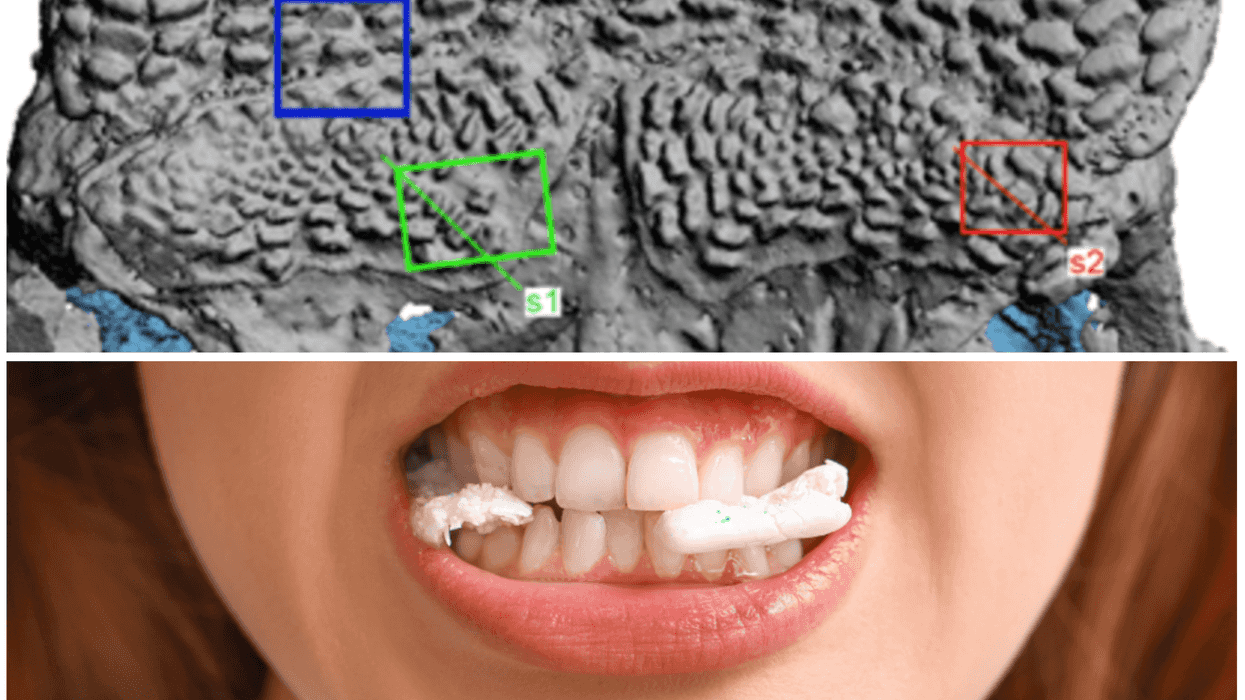

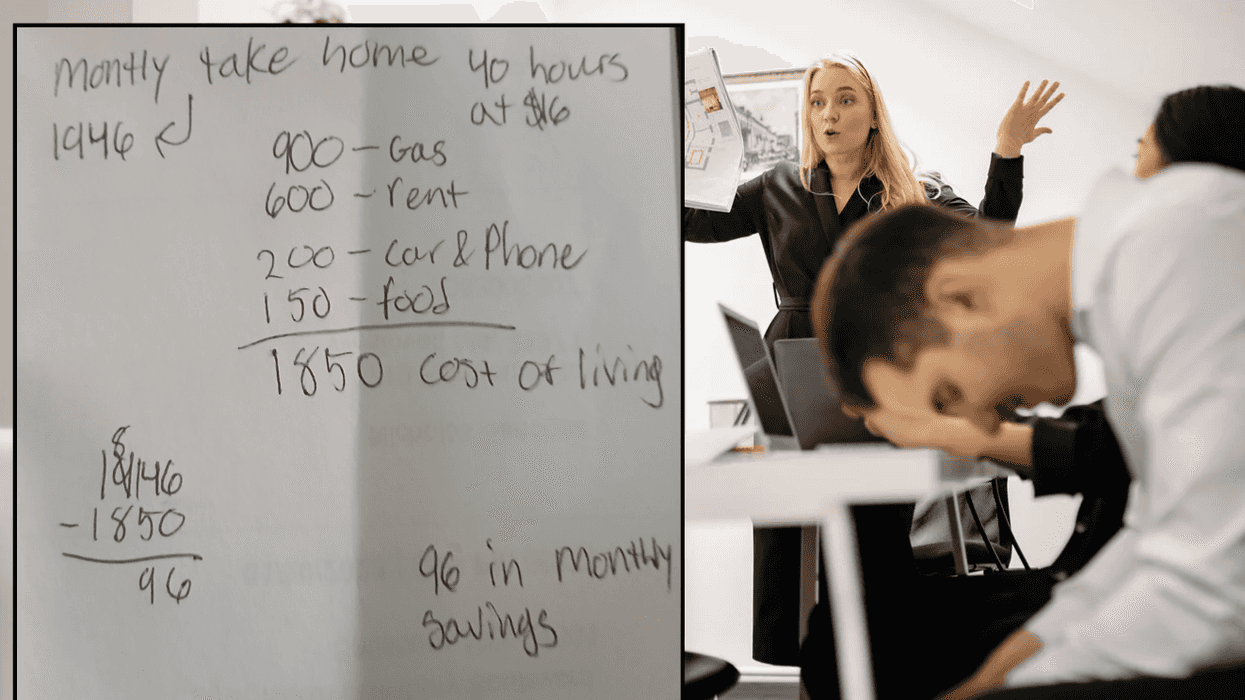

A young person doing their monthly budgetCanva

A young person doing their monthly budgetCanva

Gif of little dog holding guitar with caption "Time For Tacos" via

Gif of little dog holding guitar with caption "Time For Tacos" via

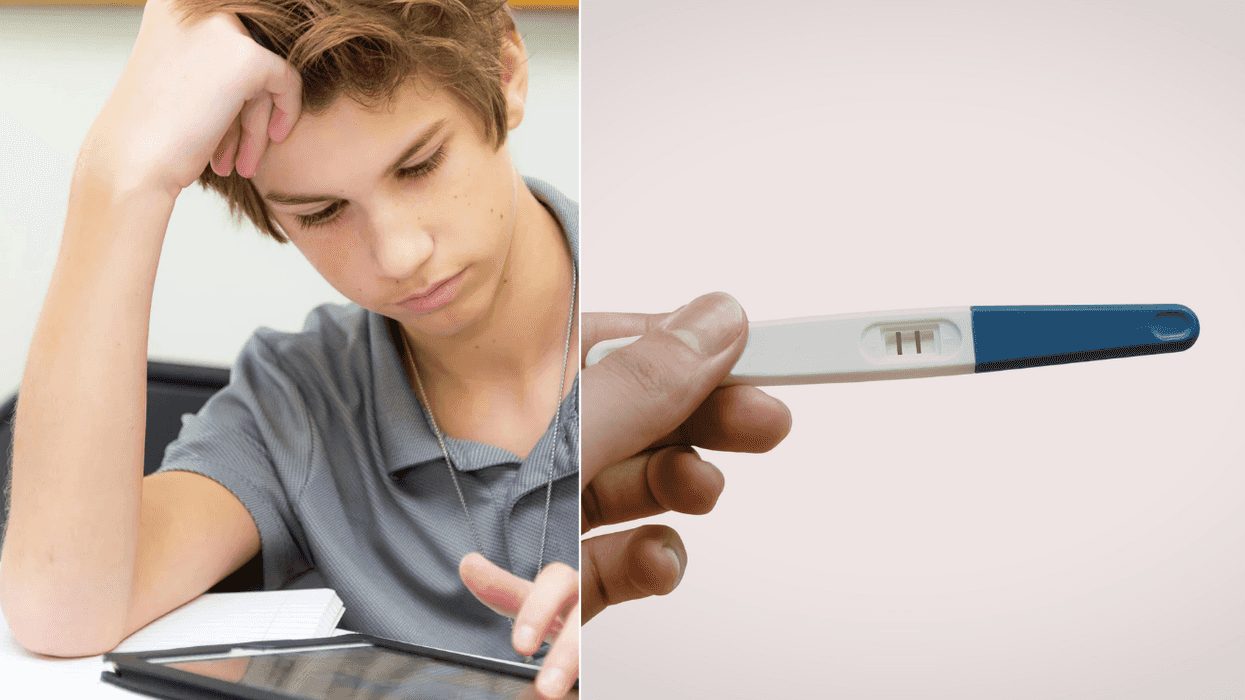

A couple engages in a serious conversationCanva

A couple engages in a serious conversationCanva

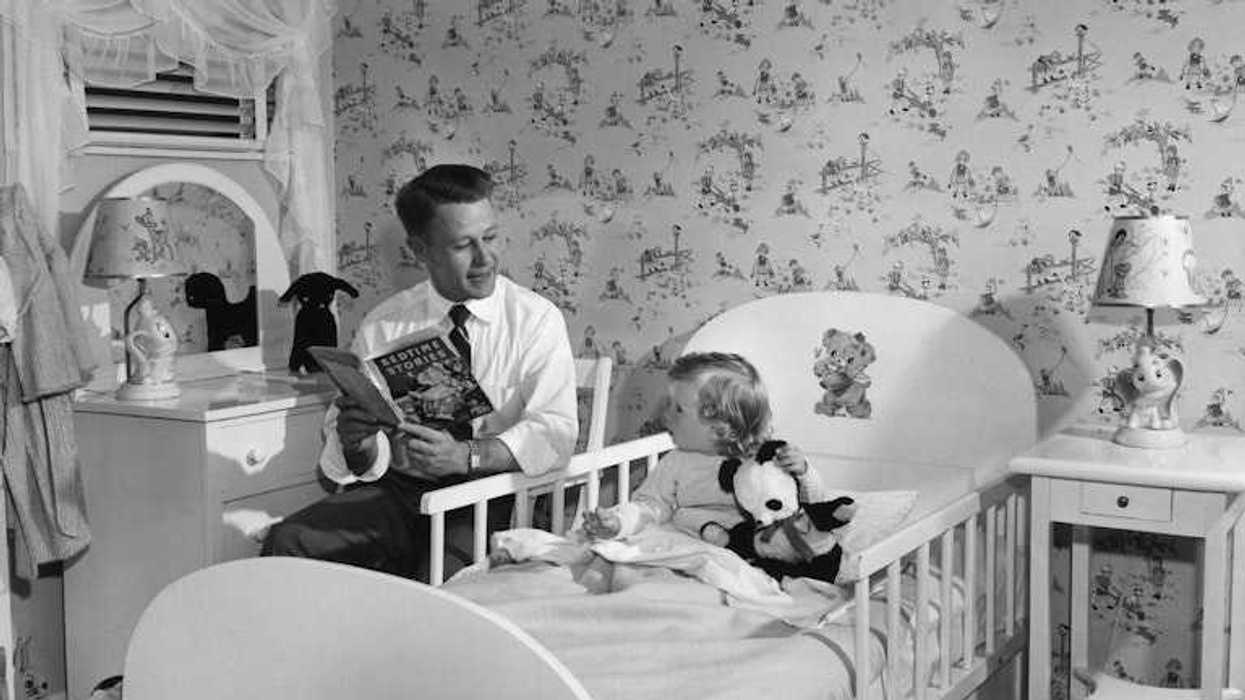

Christy Lam-Julian, a mother in Pinole, Calif., reads to her son in April 2025.

Christy Lam-Julian, a mother in Pinole, Calif., reads to her son in April 2025. Children who read bedtime stories with their parents are likely to benefit from a boost in creativity – especially if they consider questions about the books.

Children who read bedtime stories with their parents are likely to benefit from a boost in creativity – especially if they consider questions about the books.

A woman scrolls through a dating appCanva

A woman scrolls through a dating appCanva

Openly choosing the one you like best can help break down stigmas.

Openly choosing the one you like best can help break down stigmas.