For 80% of Americans, the classic "American dream" of homeownership is slipping away, according to ABC News. With soaring real estate prices, stagnant wages, and a severe housing shortage, many find themselves in a Catch-22: while buying a home can build wealth, it requires significant wealth upfront. Statista reported in August 2024 that most Americans can no longer afford the average home. Zillow's research shows that to comfortably buy a typical house, one would need to earn around $106,500 annually.

The situation for homebuyers worsened during the pandemic, when historically low mortgage rates collided with a limited housing supply. According to Wealth Vieu, the median-priced home now costs $417,600, with the typical household income at $99,589—a number that has risen sharply in recent years.

Speaking to Fortune, Ali Wolf, housing market research firm Zonda’s chief economist, said that they’re observing a steep rise in the population of renters than those of homeowners, plus the share of new home projects under $300,000 was declining all across the country. “We’re creating, inadvertently, a renter society not because of choice but because of force,” Wolf said, adding that, renting is considerably cheaper than buying. According to Yahoo Finance, GOBankingRates found that the minimum salary needed to comfortably afford a home ranges between an average of $50,000 to $200,000. Redfin reported that a person needs to make almost $76,000 a year to buy a starter home.

But what makes a house affordable? According to CBS News, a house is considered affordable if a buyer spends no more than 30% of their pre-tax income on housing costs, including mortgage payments. This threshold has critically risen by 80% in the previous years. Yet, wages have not grown as fast as the mortgage rates have. Today, not even the high-wage earners can afford to buy a home in large metro cities in America.

"Housing costs have soared over the past four years as drastic hikes in home prices, mortgage rates, and rent growth far outpaced wage gains," Orphe Divounguy, a senior economist at Zillow, told CBS News. He added that high housing costs are propelling Americans to buy properties in more affordable parts of the country. The solution to this, he said, is to create more housing supply. “The key to improving affordability long term is to build more homes.”

Some of the affordable cities in the U.S. include Pittsburgh, where a person can buy a house at an income starting with $58,200. Birmingham, Alabama, Cleveland, Memphis, Tennessee, and New Orleans are also relatively affordable for prospective home hunters. The most expensive city in America is San Jose, California. According to CNBC, a household needs to earn $463,887 to afford a median-priced home in San Jose, California, making it the most expensive of the 50 largest U.S. cities. Apart from California, other expensive cities include Salt Lake City, Austin, Sacramento, Portland, Riverside, Washington, Miami, Denver, Boston, New York City, Seattle, Los Angeles, San Diego, and San Francisco.

A symbol for organ donation.Image via

A symbol for organ donation.Image via  A line of people.Image via

A line of people.Image via  "You get a second chance."

"You get a second chance."

36 is the magic number.

36 is the magic number. According to one respondendant things "feel more in place".

According to one respondendant things "feel more in place".

Some plastic containers.Representational Image Source: Pexels I Photo by Nataliya Vaitkevich

Some plastic containers.Representational Image Source: Pexels I Photo by Nataliya Vaitkevich Man with a plastic container.Representative Image Source: Pexels | Kampus Production

Man with a plastic container.Representative Image Source: Pexels | Kampus Production

Canva

Canva It's easy to let little things go undone. Canva

It's easy to let little things go undone. Canva

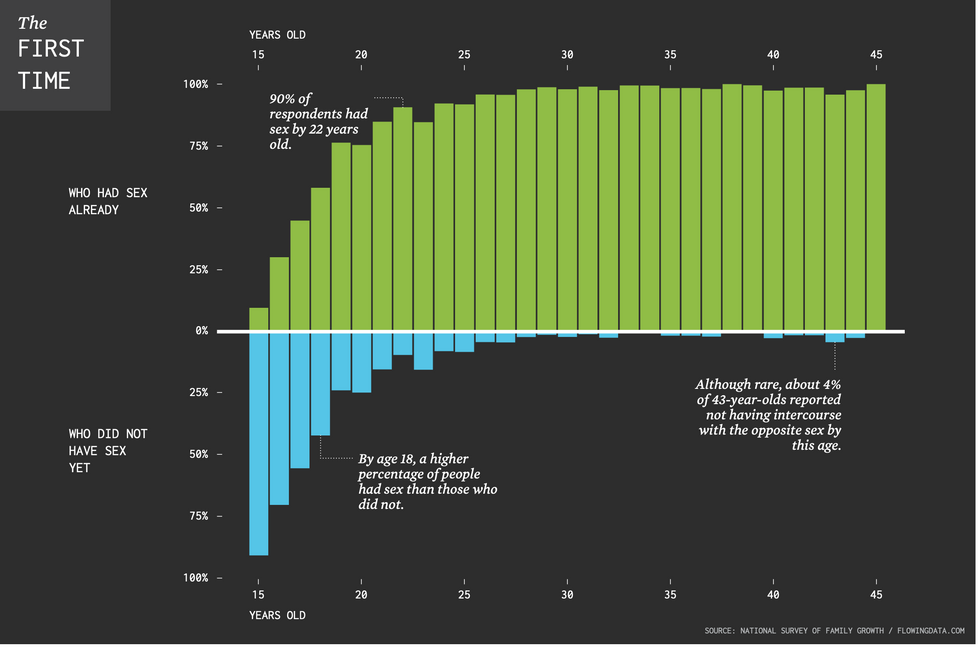

Teens are waiting longer than at any point in the survey’s history. Canva

Teens are waiting longer than at any point in the survey’s history. Canva Chart on the age of a person’s first time having sex.National Survey of Family Growth/flowing data.com | Chart on the age of a person’s first time having sex.

Chart on the age of a person’s first time having sex.National Survey of Family Growth/flowing data.com | Chart on the age of a person’s first time having sex.

Kids know the good adults from the bad.

Kids know the good adults from the bad.