You may have walked past the sea-green sign in cities all over the world, from Bosaso to Hargeisa to Mogadishu, from Dadaab to Detroit to Dubai. The inconspicuous storefront follows the scattered Somali people wherever they settle, inscribed with an unassuming, sans serif font that reads: “Dahabshiil: Fast Money Transfer You Can Trust.”

Dahabshiil is Somalia’s largest remittance operator, managing over two thirds of the payments sent home from family members working abroad. This money is an essential source of income for a struggling nation entrenched in a 23-year-old civil war. In 2012, The Africa Report named the company’s CEO, Abdirashid Duale, the world’s fourth most influential African.

In June, in a conference room overlooking Piccadilly Circus in London’s trendy West End, Abdirashid wears a nondescript sports jacket and slacks, lightly rumpled, without a tie. At 37, his hairline rests far back on his head, but baby fat still creeps around his face. Somalis often refer to him as “the Big Man.” Although Dahabshiil has a strong presence and long history in London, the company doesn’t have any big corporate headquarters here. The conference room we’re sitting in is borrowed.

“Our community doesn’t live in this kind of nice building, in this kind of nice area,” Abdirashid says, gesturing out the window. “Where we have our locations is where they live.” He lists off all the local neighborhoods with Somali communities: East London, South London, Southall, Streatham, Wembley, Wollwich.

Dahabshiil is one of many Somali-run companies created over the past few decades to help move cash into, around, and out of Somalia, whose national bank collapsed in 1990. Its signs butt up against those for other remittance and cash storage services like Amal Express, Amana Express, Hodan Global, Iftin Express, Kaah Express, Mustaqbal, Olympic, Qaran Express, and Tawakal Express. Dahabshiil though, whose name literally means gold smelter, has grown rapidly since the turn of the century to dwarf them all, with over 20,000 outlets spread officially across 128 countries.

[quote position="full" is_quote="true"]Somalis... They’re entrepreneurs. They’re risk takers. They have creativity. They’re people who are free.[/quote]

But the company is in limbo. Last May, Abdirashid received a letter from Barclays threatening to revoke the banking services that money transfer operators (MTOs), like Dahabshiil, and over 100,000 Somalis in the U.K. depend on to send home at least $160 million each year. In November, the High Court of Justice, one of English law’s highest civil courts, granted an interim injunction in favor of Dahabshiil that preserved their banking services until a full trial could take place, but over the past year, letters from other banks keep arriving, tightening the stranglehold on Abdirashid’s company, its competitors, and a country whose economy relies on this income.

***

Dahabshiil’s rise to eminence isn’t just a tale of clever business maneuvering. It is the story of a family starting from scratch after fleeing civil war, navigating confusion and division to rebuild their lives, and helping reverse the erosion of security amongst their people.

Fifty years before the Barclays letter, in the desiccated plains of Togdheer in north-central Somalia, Mohamed Said, Abdirashid’s father, lived as a nomadic camel boy. When he turned 18, his family sent him to apprentice with a trader in the scrubby, centrally located administrative hub of Burao, where he discovered a passion for business. Around 1968, with savings from his apprenticeship, he opened his own merchant business and general store, ferrying clothes, shoes, flour, sugar, and other essentials from Yemen to Somalia.

Abdirashid, who was born in 1977, grew up around his father’s business. “In the UK, you have corner shops, which Indian families own. You have a father and son working the shop and the family living upstairs. My family started like that,” he says. “I started working with my father at a very early age, learning from him as he did business.”

From age eight, Abdirashid spent hours each day at his father’s side. “As the customers came in, he’d talk with them, joke with them,” Abdirashid says. He says he learned the value of hard work and to treat everyone equally. “If people trust you, you have to trust them. If you promise something, deliver it.”

But things were starting to collapse in northern Somalia. Major General Siad Barre ruled the country—he seized power in a mostly bloodless military coup in 1969, after the unrelated assassination of the young nation’s beleaguered second president, Abdirashid Ali Shermarke. Barre and his military associates garnered some early popularity (and Soviet support) by preaching anti-clanist rhetoric, introducing a Somali script to promote parity between Somali and colonial languages, and nationalizing all major businesses and industries, in the name of an equalizing form of Marxism.

Barre spun his power and support into a cult of personality, lining the streets and filling the media with his likeness and words. But by 1978, after suffering a disastrous defeat in a yearlong war to conquer southern Ethiopia, an ethnic Somali region carved out of Somalia by colonial treaties, the president’s power weakened. Facing blowback from a restive population, Barre grew paranoid. He rounded up and executed a clutch of governmental and military officials and launched an era of divisive clan politicking and iron-fisted totalitarianism.

In 1988, after a decade of conflict with dissident militias, chief amongst them the northern Somali National Movement, Barre ordered northern Somalia to be carpet-bombed. In one extreme bout of excessive violence, he commanded air force pilots in the northern political center of Hargeisa (now the capital of the de-facto independent state of Somaliland) to take off from their base, and turn around to bomb their own city, reducing it to rubble.

As Barre’s forces advanced through the north, they clashed with the Somali National Movement in Burao in late May of 1988. In a scene mirrored in towns throughout the region, soldiers rampaged the streets, sometimes with bazookas, shooting civilians and dragging locals out of their homes for public executions. Faced with slaughter, Mohamed Said and some 800,000 other refugees fled west, bringing only what they could carry on their back, to the Ogaden plateau, home to the Somali ethnic regional state in southeastern Ethiopia. He eventually settled with his family in a small shack in Dire Dawa, an independently chartered city and trade hub in the northern part of the Somali state that served as the base of the Somali National Movement.

Even on the run, Mohamed Said maintained contact with his business associates and friends around the Gulf. In the mid-80s, he helped families in Burao circumvent Barre’s banking crackdowns by quietly trafficking cash from relatives working abroad. He would buy trade goods with foreign currency, import the products into Somalia, sell them domestically, and use the proceeds to pay Somali families with local currency. In Dire Dawa, using those same trade networks, Mohamed Said launched Dahabshiil, deploying a network of bike messengers to carry cash and letters to family members in Somalia, Somaliland, and the refugee camps.

Unlike many of the other MTOs around at the time, Mohamed Said served refugees from all different clans. Though tribes that had fought for years inside Somalia eyed each other warily as they settled in the same displacement camps, as a teenager Abdirashid says he never noticed the factionalism. His father rarely spoke of clans, emphasizing the adage that, if someone trusts you with their money, you have to trust them. “A member of [Siad Barre]’s family used Dahabshiil,” Abdirashid admits. “And I have no problem with that.”

As war dragged on, Somalis started to move beyond Ethiopia, and the Duale family went with them. Dahabshiil set up shop in Djibouti, Kenya, Rwanda, Uganda, and Britain, where Mohamed Said eventually relocated his family, picking up new customers not just from Somalia, but a variety of refugee situations. “If you go to certain parts of London or other communities, Somalis live with Rwandans or people from Kenya or from Sudan or South Sudan.” Abdirashid says. “They have similarities because some of these countries come out of civil war. They have the same kind of experience in the diaspora.”

Serving all those displaced, Mohamed Said built a global business. “The Somali have a culture of helping one another,” Abdirashid says. “That’s why we are in the business we are in. That’s somehow rooted in Somali culture: Help your extended family. Help whoever’s less fortunate than you are.”

In turn, scattered Somali communities started to engage in an activity rarely seen during Barre’s violent dictatorship: trust. “When I think of Dahabshiil, what comes to mind is KFC and Walt Disney,” says Saeed Abdi, a Somali native who runs Maan, a Somali mental health organization in Sheffield, UK. He’s been using Dahabshiil for twenty years. “With the Somalis, it is a world of trust. It is that brand you trust. And it’s just something about the old man, Mohamed Said, and his son that you trust.”

***

In 2001, despite its growth, Dahabshiil was still a family affair, just one of the many money transfer services competing for business with al-Barakaat, the long-established giant. But on September 11, everything changed.

In the effort to identify a culprit for the attacks, American politicians kicked up paranoia about the danger of small money transfer companies. They decided that remittance operators could be the means for funding militants and terror cells like al-Qaeda. Under the banner of anti-laundering laws, the US Congress launched a series of financial reforms that, thanks to the primacy of the US dollar in money transfers and international financial services, would crush virtually every Somali remittance service under a mountain of paperwork.

The US government specifically targeted al-Barakaat. In addition to its remittance business, the company operated a series of telecom, internet, construction, and travel firms across 40 countries. But since the mid-90s, it had been under investigation for possible terrorist connections and financial malfeasance by several US government agencies. In November, 2001, this scrutiny kicked into overdrive; then-Treasury Secretary Paul O’Neil dubbed al-Barakaat the “quartermaster of terror,” named its leader, Sheikh Ahmed Ali Jima’ale, an “associate” of Osama bin Laden, and led an international charge to raid, seize, and freeze the company’s assets.

Though the US government still argues their intelligence was solid, F.B.I. investigations from as early as 2002 offer little proof to back up the accusations. In 2004, the 9/11 Commission Report reported that the bulk of the funding for the attack traveled through conventional wires and bank accounts, hidden by the complexity and anonymity of the international financial system, rather than through MTO money launderers. Still, it took the US and other governments about a decade to pare down their blacklists, gradually liberating the assets of the by-then shrunken al-Barakaat and companies of its ilk.

As Abdirashid, then in his twenties, took on more responsibilities at Dahabshiil, eventually taking on his current role of CEO, he and his employees learned to provide paper and electronic transcripts of every transaction to public institutions to verify the flow and receipt of money. “It became more of a headache and more expensive,” he says, “but we had no choice except to follow the regulations.”

As so, as many Somali MTOs vanished, Dahabshiil expanded. According to research conducted by Peter Hansen, then of the Danish Institute for International Studies, Dahabshiil controlled up to 70 percent of the Somali remittance market by 2004. Dahabshiil also manages resources for most major international organizations, including Oxfam, the United Nations, and World Bank, who rely on the company to funnel cash to their Somali operations.

The company’s ubiquity has turned Abdirashid into something like a rock star in his country, and Dahabshiil into a persistent topic of conversation. Abdirashid is also known for his philanthropy, building hospitals, funding schools and supporting cultural events. “There are now seven or eight television channels in Somalis in my region [of Somalia],” says Saeed. “And Dahabshiil is constantly visible on them.”

Dahabshiil is an overwhelming point of national pride, both as a rare institution worthy of trust and as a foundation for Somalia’s hopeful future. “People are moving on,” says Abdirashid. “Busses are full, people are sitting in cafes, and people are building big houses.”

***

Cos Axmed Jama is one of those moving on. Years ago, Cos and her husband were garment merchants in Mogadishu, the old capital of Barre’s Somalia and current capital of the internationally backed federal government. Like so many others, the Somali conflict forced her to close her shop and go into exile. Now she’s one of the 41 percent of Somalis who are unable to generate enough food or income to support themselves and thus rely on remittances to survive.

I met Cos last year, at her home in Hargeisa, the rebuilt Somaliland capital and one of Dahabshiil’s regional headquarters, where many displaced southerners have fled. Her dim concrete box is strewn with pillows and rugs. She is a quiet widow, in her mid-fifties, who speaks in short, direct bursts, and works for a local, Somali-run HIV awareness and prevention group.

Cos’ younger son in Italy isn’t making enough money yet to send any home, but her older son in Ireland sends her and her three daughters around $300 dollars a month. Cos manages the money, using it to support her household, put the kids through school, develop credit relationships with local vendors, and even tuck away some savings. She doesn’t worry about the Irish economy—when I brought up the country’s billion-dollar federal bailouts of its biggest banks, she hadn’t heard the news. “If God wills that I should have money, then I will,” she says, staring off. “If not, I will find another way to survive.”

But Cos is optimistic. The one time she perks up in our conversation is when she mentions her community activism. She explains that the remittance money gives her the flexibility to dedicate time to issues she cares about like sexually transmitted disease. And, if the worst happens and she’s cut off from funds, Cos is confident that she can use what she’s saved to open another clothing stall in a local market.

Somalis like Cos, who are achieving security, investing money into small, local businesses, and developing more robust social services, are building a new backbone for the country. “Somalis, their DNA is trade,” Abdirashid says. “They’re entrepreneurs. They’re risk takers. They have creativity. They’re people who are free. I’m part of that community, [of people] who want to work and want to work hard.”

The rebirth of Somali infrastructure depends almost entirely on remittances. Somalis in the diaspora send home between $1.2 and $2 billion in remittances every year, over half the national income, and over four times the revenues of the region’s main export: agricultural products. In comparison, humanitarian aid to Somalia from 2007 to 2011 averaged $834 million a year. In 2011, despite all the economic growth and development in the region, official unemployment still hovered around 23 percent for men and 62 percent for women. If Somalia’s entire remittance income disappeared, the underpinnings of a new country could wash away entirely.

***

Last May, just days after the Muslim News Awards ceremony in London, where the British Shadow Chancellor Ed Balls awarded Dahabshiil the 2013 “Excellence for Enterprise Award” recognizing the company’s role in social and financial development, Abdirashid received the letter from Barclay’s, one of the last British banks willing to facilitate money transfers in Somalia. They informed him they were terminating their relationship with Dahabshiil and a number of other MTOs.

It wasn’t Dahabshiil’s fault, the letter stressed, but a reflection of ever-tightening financial regulations on remittances. Abdirashid and his lawyers scrambled, managing to avert disaster and, in a confidential settlement, extend their relationship past the October 2013 severance date. It’s just one of the many legal threats MTOs have faced in recent years.

Abdirashid is trying to plan for Dahabshiil’s future. Somalis have set up clever institutions, like communal cooperatives that pool savings and assign loans by lottery, to help members pay for large expenses or start new businesses. But they still have no reliable, full-service banks. They have no access to secure loans, no insurance, and no means of attracting large-scale foreign investment. For years, Abdirashid has been working to turn Dahabshiil into a full-fledged bank, opening the Islamic Bank in Djibouti and experimenting with insurance, letters of credit, interbank transfers, e-cash, and debit cards, while he waits for cautious local governments in Somaliland to green-light commercial banking laws.

But for now, he and so many others are stuck fighting the same battle that sank al-Barakaat in 2001. In July 2014, news emerged that one of the last American banks facilitating money transfers, Merchants Bank of California, plans to close its doors to MTOs due to new waves of anti-laundering pressure, likely fueled by concerns over the recent resurgence of well-funded militant groups throughout the world.

Regardless of the validity of money laundering fears, Abdirashid is working with the UK to develop solutions that better facilitate formal money transfers into Somalia. But change is slow. In May, US Congress passed the Money Remittance Improvement Act, which, despite its hopeful name, reduces the number of enforcers monitoring existing regulations, not the actual number of regulations.

Abdirashid thinks the US and UK governments know that letting Dahabshiil and its peers fail will force remittances underground, into the totally unregulated black market. But you can sense the exasperation in his voice. “You have the US or UK government saying, ‘We want to rebuild Somalia. We want to help Somalia,’” he says. “‘We want the diaspora to have a role. We want democracy there. We want economic development there.’ But then you have an old lady who can’t receive her $200.”

Correction: A previous version of this story stated that Abdirashid has no office in London. He has a desk in Dahabshiil's regional office.

Screenshots of the man talking to the camera and with his momTikTok |

Screenshots of the man talking to the camera and with his momTikTok |  Screenshots of the bakery Image Source: TikTok |

Screenshots of the bakery Image Source: TikTok |

A woman hands out food to a homeless personCanva

A woman hands out food to a homeless personCanva A female artist in her studioCanva

A female artist in her studioCanva A woman smiling in front of her computerCanva

A woman smiling in front of her computerCanva  A woman holds a cup of coffee while looking outside her windowCanva

A woman holds a cup of coffee while looking outside her windowCanva  A woman flexes her bicepCanva

A woman flexes her bicepCanva  A woman cooking in her kitchenCanva

A woman cooking in her kitchenCanva  Two women console each otherCanva

Two women console each otherCanva  Two women talking to each otherCanva

Two women talking to each otherCanva  Two people having a lively conversationCanva

Two people having a lively conversationCanva  Two women embrace in a hugCanva

Two women embrace in a hugCanva

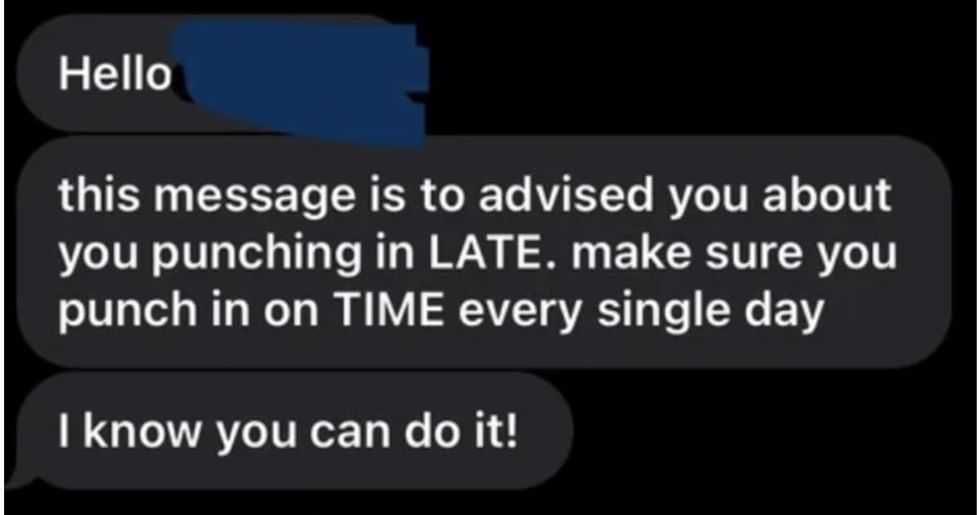

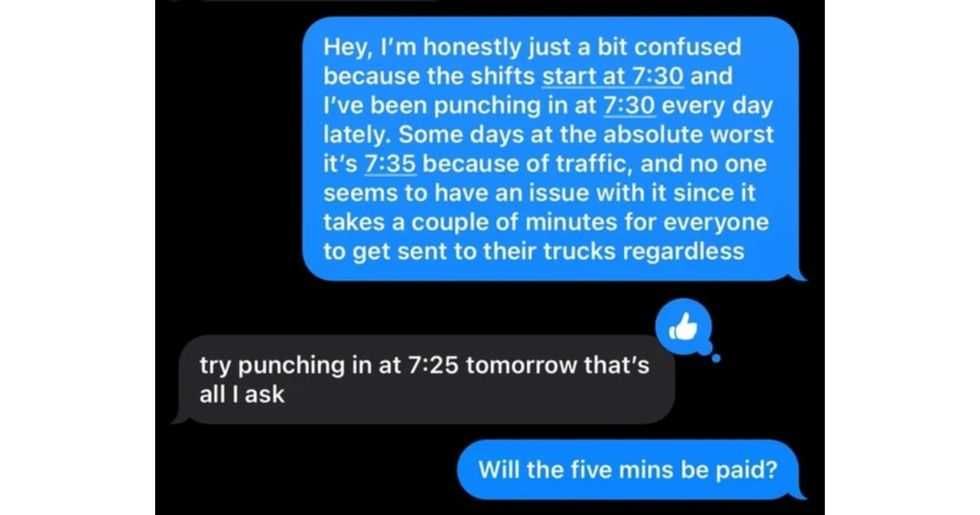

A reddit commentReddit |

A reddit commentReddit |  A Reddit commentReddit |

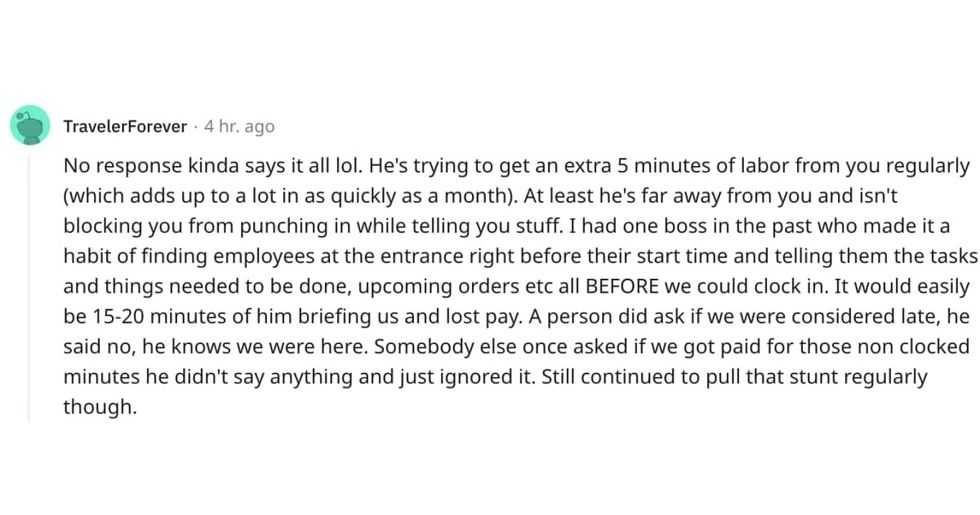

A Reddit commentReddit |  A Reddit commentReddit |

A Reddit commentReddit |  Stressed-out employee stares at their computerCanva

Stressed-out employee stares at their computerCanva

Who knows what adventures the bottle had before being discovered.

Who knows what adventures the bottle had before being discovered.

Gif of young girl looking at someone suspiciously via

Gif of young girl looking at someone suspiciously via

A bartender makes a drinkCanva

A bartender makes a drinkCanva