Last week, after numerous iterations and alleged in-fighting, the GOP finally agreed on a replacement plan for Obamacare. Already dubbed “Trumpcare” or “Ryancare,” perhaps because it so closely resembles Speaker Paul Ryan’s “Better Way health care” plan of 2016, the American Health Care Act (AHCA) has failed to impress either the American Medical Association or the AARP. Even right-wing advocacy groups such as Heritage Action were not pleased.

You may have heard that the bill, if passed, will penalize people who lose coverage for as little as two months. Yet it also removes the individual mandate to purchase insurance—and thus the money that made it possible to insure millions under the Affordable Care Act (ACA). But it’s hard to suss out what’s really at stake for the majority of Americans, especially as the bill is still entirely hypothetical. Should you really be worried?

To get some perspective, we spoke with Daniel Dawes, a Georgia attorney with expertise in health policy and the author of 150 Years of Obamacare (Johns Hopkins University Press, 2016). Instrumental in the negotiations around health reform during the creation of the ACA law, Dawes organized the National Working Group on Health Disparities and Health Reform, a working group of more than 300 national organizations and coalitions that ensured the health reform law included equity provisions, reducing disparities in health status and health care.

How will the AHCA, should it pass, affect people who currently purchase their insurance through the health care exchanges under the ACA?

What the bill will do is change the health insurance exchanges to such a degree that it would negatively impact your ability to purchase affordable health insurance. It would reduce the credits that go to folks who are lower income and who are older. And, interestingly enough, those who are healthier and wealthier would benefit under the Republican plan because the essential plan is to put more of the cost of health insurance on those who are older—and, as a result, sicker.

The bill proposes encouraging people to get health savings accounts (HSAs) to pay for health care, right?

Based on the studies we’ve seen, low-income individuals would not benefit from an HSA. Just to give you an example, let’s say your pre-tax income is $5,000 a month for a family of four. You need to have spare income socked away in the account for medical expenses. Chances are, even if you have a spare $5,000 a month to put into your account, it still wouldn’t be enough to cover health care costs even for one visit to an urgent care facility.

[quote position="left" is_quote="true"]The essential plan is to put the costs on those who are older and sicker.[/quote]

Moreover, don’t forget you can’t use what you don’t have. So if you have $700 in the account and your medical bills are $3,000, you’re responsible for paying the remainder. So it’s clear HSAs will only benefit a small percentage of Americans. And they’re going to leave out most of the people who currently opt in to the Obamacare health care exchanges.

How will Medicaid be affected by the bill?

The bill wants to place a per capita cap. So under the Medicaid program right now, there’s this open-ended amount of money. We have been helping the greatest amount of people in need for years. Let’s say we have 100 people in the system and the cost of providing Medicaid increases because they have stage 4 cancer or heart disease. The states will fund it, but the feds will usually match that and cover the cost between 55 and 75 percent. On a per capita cap basis though, what they’re saying is, we’re going to give you a certain amount per Medicaid beneficiary. And once that’s been exhausted in terms of providing care for these individuals, that’s it. It’s no longer open-ended anymore.

Now, the state will have to figure out how in the world they will come up with the additional funds. That’s going to be a tremendous burden on the state and that’s why you’re seeing so many Republican governors a little perturbed by that policy.

What’s the difference between the subsidies the ACA provided and the tax credits the AHCA is providing?

Under the current law, the ACA, you’re able to immediately get the subsidies and use them to purchase your insurance coverage to pay for your premiums. And if you make less than 250 percent of the federal poverty level, you also are able to get a cost-sharing subsidy to help pay for any copayments you have. Under the Republican plan, they would want to get rid of the cost-sharing subsidies.

[quote position="full" is_quote="true"]Republican governors are a little perturbed because there's going to be a tremendous burden on the state.[/quote]

Also, before they reach Medicare, folks who are in their 50s, actually even in their 40s to 60s, are going to experience sticker shock. They’re usually the folks who need insurance the most. For many, chronic diseases have impacted them negatively. So those are the populations who are most vulnerable.

Younger folks may love the Republican plan because it will make it cheaper on them, but older folks will suffer. Wealthier folks will love the plan, but low-income folks will suffer.

The bill would get rid of the individual mandate to purchase health insurance. What does that mean for the cost of premiums?

Under the system right now, you have a group of healthy folks included with the sicker folks who are spreading the risk. If you don’t have the individual mandate and you allow healthier individuals to exit, it will cause a death spiral in the market. And if you think a high-risk pool would be the solution, what insurance company would ever want to participate in that type of marketplace? I’m not a huge fan of these high-risk pools because they have a detrimental effect on the most vulnerable among us.

You think you’ve seen sticker shock with the ACA? We’re looking at a $3,200 premium on average. If it’s repealed, we’re looking at an increase to $4,700. It would cut the number of insured individuals in our country across the board.

How does the bill affect mental health care?

The ACA was the greatest expansion of mental health protections than we have ever seen in this country, including mental health and substance abuse addiction coverage. The ACA mandates mental health coverage and, in addition to that coverage, it mandates rehabilitation and habilitation coverage for individuals who have a substance abuse issue that’s impacted their cognitive or bodily ability. The ACA also expanded protections for folks who have no health coverage. All of these are in jeopardy under the Republican bill.

A lot of the major changes won’t take effect until closer to 2020. Why is that?

To counter any severe or negative impacts expected to happen under this bill because most think tanks, either conservative or liberal leaning, as well as the Congressional Budget Office, have already scored these and found these proposals would result in higher uninsurance rates and greater costs to the consumer. There’s a political strategy to push this out until after the 2018 elections and the 2020 presidential election.

Oral Wegovy pills were approved by the Food and Drug Administration in December 2025 and became available for purchase in the U.S. in January 2026.

Oral Wegovy pills were approved by the Food and Drug Administration in December 2025 and became available for purchase in the U.S. in January 2026. Despite the effectiveness of GLP-1 drugs for weight loss, there is still no replacement for healthy lifestyle patterns, including regular exercise.

Despite the effectiveness of GLP-1 drugs for weight loss, there is still no replacement for healthy lifestyle patterns, including regular exercise.

What foods would you pick without diet culture telling you what to do?

What foods would you pick without diet culture telling you what to do?  Flexibility can help you adapt to – and enjoy – different food situations.

Flexibility can help you adapt to – and enjoy – different food situations.

Anxious young woman in the rain.Photo credit

Anxious young woman in the rain.Photo credit  Woman takes notes.Photo credit

Woman takes notes.Photo credit

Revenge can feel easier than forgiveness, which often brings sadness or anxiety.

Revenge can feel easier than forgiveness, which often brings sadness or anxiety.

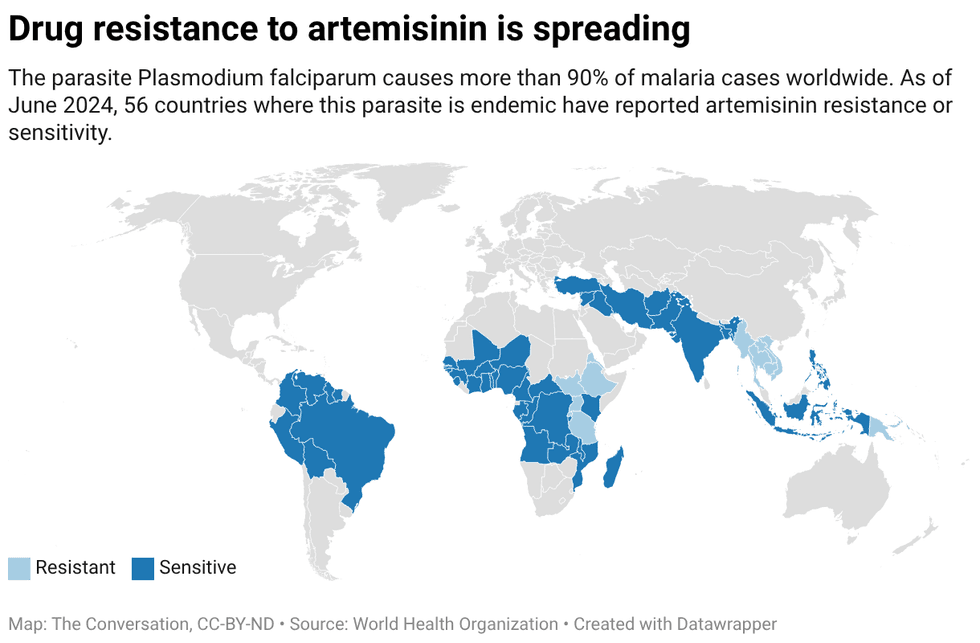

In the past two years, two malaria vaccines have become available for babies starting at 5 months of age.

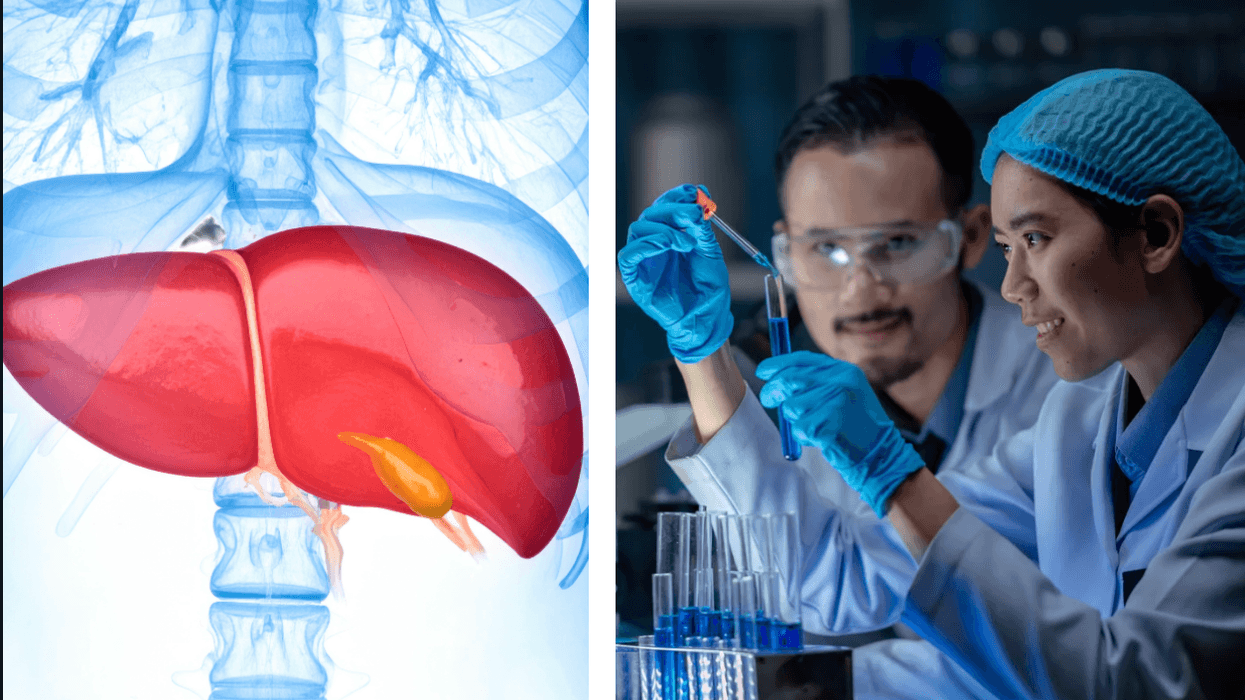

In the past two years, two malaria vaccines have become available for babies starting at 5 months of age. By exploiting vulnerabilities in the malaria parasite’s defense system, researchers hope to develop a treatment that blocks the parasite from entering cells.

By exploiting vulnerabilities in the malaria parasite’s defense system, researchers hope to develop a treatment that blocks the parasite from entering cells. Created with

Created with