The College Humor/TruTV series “Adam Ruins Everything” has found its audience by walking that elusive line that runs between “educational” and “fun.” Host Adam Conover uses skits, jokes, and scientific data to explain social issues in a digestible and concise manner. In striking that balance, he foregoes the pleasantries and sugar-coating of topics, opting for a direct and honest approach.

Which brings us to his latest target: the student loan industry, in the segment titled simply, “How College Loans Got So Evil.” In five minutes, he runs through a brief history of student loans and how systematic changes to their underwriting took them from an institution for the social good to something a little more, well, evil.

Conover is quick to point to one specific event as the tipping point that changed the nature of student loans: the deregulation and privatization of Sallie Mae in the 1990s. Since its inception in 1972, Sallie Mae had been a government institution offering standardized loans to college hopefuls. But in 1996, legislation passed that turned the agency into a private concern. The institution became a profit center just like any bank. Marketing efforts skyrocketed in order to issue more loans and collect on government fees. Sallie Mae also incentivized schools to make it the agency of choice for their students’ loans.

As expected, the lack of fair competition and transparency were detrimental to what would otherwise be a social good. Among the other trespasses perpetrated by the now-private organization: bribing financial aid officers with cruises, masquerading private reps as college employees, and encouraging students to take out more debt than they needed. All became common practice, leading to today’s crisis in which students are tempted to structure monthly payments so low that they fail to cover the accruing interest, resulting in ballooning principles to the tune of $1.3 trillion.

Consequently, a quarter of college students and graduates are behind on their loans with no hope or remedy in sight. Even the traditional last resort for borrowers — bankruptcy — is off the table since student loan obligations are one of the few debts that aren’t wiped clean after the declaration. 8 million borrowers are currently in default, and while the obligations remain — to the benefit of lenders — something’s going to give sooner or later.

So while the segment’s title “How College Got So Evil” might sound sensationalist, you’ll realize after watching this clip that it’s not a mischaracterization.

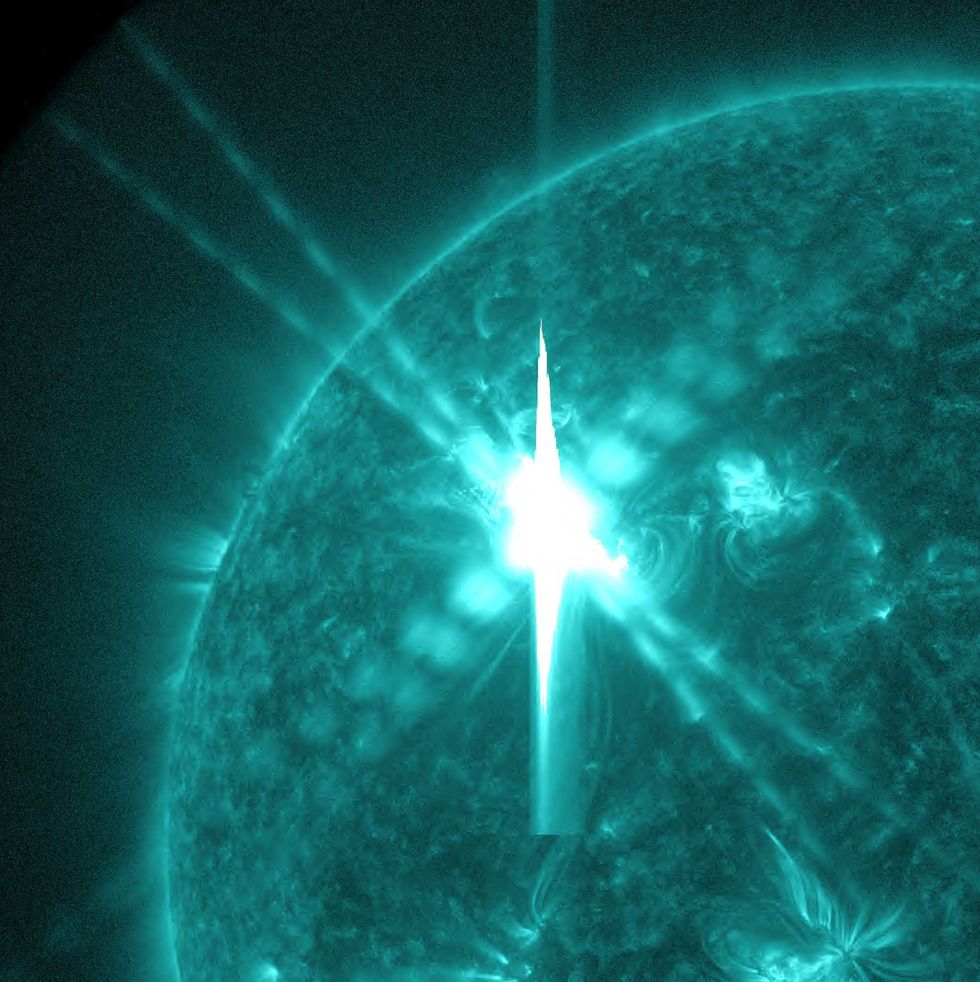

Image artifacts (diffraction spikes and vertical streaks) appearing in a CCD image of a major solar flare due to the excess incident radiation

Image artifacts (diffraction spikes and vertical streaks) appearing in a CCD image of a major solar flare due to the excess incident radiation

Ladder leads out of darkness.Photo credit

Ladder leads out of darkness.Photo credit  Woman's reflection in shadow.Photo credit

Woman's reflection in shadow.Photo credit  Young woman frazzled.Photo credit

Young woman frazzled.Photo credit

A woman looks out on the waterCanva

A woman looks out on the waterCanva A couple sits in uncomfortable silenceCanva

A couple sits in uncomfortable silenceCanva Gif of woman saying "I won't be bound to any man." via

Gif of woman saying "I won't be bound to any man." via  Woman working late at nightCanva

Woman working late at nightCanva Gif of woman saying "Happy. Independent. Feminine." via

Gif of woman saying "Happy. Independent. Feminine." via

Yonaguni Monument, as seen from the south of the formation.

Yonaguni Monument, as seen from the south of the formation.