America’s student debt crisis reached a new record-high in 2017, with a total balance of $1.3 trillion among 44 million borrowers—17 million of which are under the age of 30. It’s hard enough to pay the bills in your 20s. The addition of a few hundred dollars to your monthly payments can break your bank account. And for many millennials, it has; the majority have missed a student loan payment to cover basic needs like groceries and rent.

Which is a big problem, since unlike most other debt, such as car loans, mortgages, or credit cards, declaring bankruptcy with student loans isn’t an option. That’s thanks to a 1978 law passed in reaction to a wave of students trying to declare bankruptcy upon graduating. The law, which made federal student loans nondischargeable in bankruptcy, still stands today—and now includes private loans as well—making it extremely difficult for debt-ridden individuals to bring their heads above water.

Fortunately, there’s a movement growing among lawyers across the United States who want to challenge these decades-old bankruptcy laws to reflect today’s economic reality. New York City-based attorney Austin Smith became one of them after he discovered a loophole in bankruptcy code a few years ago. With the current law, the only way student debt can be waived is if a borrower proves that repaying a loan would cause an “undue hardship”—an extremely vague, yet inordinately hard legal standard to meet. But, Smith found that in many cases, the courts had historically misinterpreted the laws, falsely deeming student debts as student loans under the bankruptcy code.

[quote position="full" is_quote="true"]These are the people the bankruptcy laws were designed to protect.[/quote]

Smith’s first client was a law student who’d accrued $15,000 in debt from studying for the bar. The bank immediately classified her loan as a student loan because she was studying, but she wasn’t actually affiliated with an academic institution at the time. Going off the bank’s classification, the court deemed her debt nondischargeable. Smith, however, was able to prove that her loan wasn’t technically a student loan under the bankruptcy code and therefore could be erased.

Smith’s logic can be applied to other private lender cases as well. For example, if someone took out a loan for more than the total cost of tuition, their debt could be discharged. The same applies for people who were attending unaccredited trade programs, like career training, K-12 education, as well as nonaccredited colleges and universities. Though most people with student debt have federal loans, a growing number are taking out loans from independent companies, which often have even higher interest rates. At the end of last year, private loans made up roughly 8 percent—or $102 billion—of all student loans.

“This won’t solve the whole student debt problem,” Smith admits, “but it will provide relief to the few million people who are really struggling. These are the people the bankruptcy laws were designed to protect.”

Smith has won 9 cases across New York, Texas, Minnesota, California, and Connecticut and is working on dozens more. His latest, a class action lawsuit against Navient, one of the largest student loan companies in the United States with 12 million accounts, was his biggest yet. And though the case isn’t over, Navient has already agreed to stop collecting debt from people who’ve filed for bankruptcy after 2005. If Smith wins this case, as many as 16,000 people could be relieved of their debt.

“You talk to these people and they are just at their wits’ end,” Smith says. “All of their money is going to interest and they are left without any options. Bankruptcy is supposed to be the last option.”

Smith isn’t the only one starting to challenge bankruptcy code when it comes to private student loans. Other lawyers are beginning to follow suit. Already, in the past 15 years, the number of bankruptcy filings that included student debt has grown more than 7 percent. And now, Smith is hoping to increase that number by even more. He’s partnered with the bankruptcy software company Best Case to utilize some of his same logic. Set to launch next week, the new software will help attorneys determine whether a client’s loans qualify for bankruptcy discharges and, if they do, show them how to challenge the debt.

“There needs to be a safety valve,” says Smith. And slowly, as more and more lawyers begin to challenge private loan companies and the historical interpretation of bankruptcy law, that safety valve will be built, giving hope and solace to a few of the millions struggling to pay off their student loans.

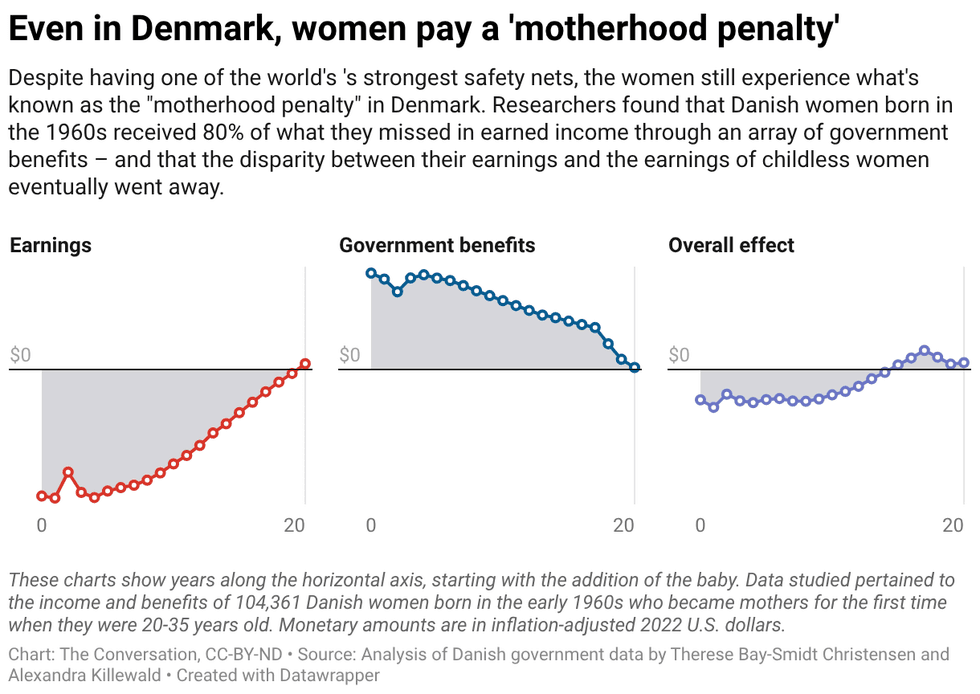

The ‘motherhood penalty’ is largest in the first year after a mom’s first birth or adoption.

The ‘motherhood penalty’ is largest in the first year after a mom’s first birth or adoption.

As mayor of Stockton, Calif., Michael Tubbs ran a pioneering program that provided a basic income to a limited number of residents.

As mayor of Stockton, Calif., Michael Tubbs ran a pioneering program that provided a basic income to a limited number of residents. Martin Luther King Jr. believed Americans of different racial backgrounds could coalesce around shared economic interests.

Martin Luther King Jr. believed Americans of different racial backgrounds could coalesce around shared economic interests.