Following New York City Mayor Bill de Blasio's Wednesday announcement that nearly 500 members of his staff would be placed on an unpaid one-week furlough in an effort to reduce government spending, progressive group Patriotic Millionaires warned that the move is "just a taste of the devastating budget cuts that are in store for New York in the coming months" and implored Gov. Andrew Cuomo to raise taxes on wealthy New Yorkers in order to avoid harmful austerity measures.

New York City is facing a $9 billion budget shortfall, and the state budget deficit has increased to $14.5 billion during the coronavirus crisis, according to Patriotic Millionaires.

To close these fiscal gaps, Cuomo has "chosen to dramatically cut spending on programs that millions of New Yorkers rely on," the group said. But that is not the only available option, the tax fairness advocates pointed out, explaining that Cuomo could "raise revenue from wealthy New Yorkers, many of whom have seen their net worths increase during the pandemic."

Morris Pearl, the chair of Patriotic Millionaires, criticized Cuomo's refusal to increase taxes on the state's wealthiest residents.

"New Yorkers shouldn't have to tighten their belts and prepare for austerity measures," Pearl argued. "There's plenty of money in this state to fund every single important government function, we just need a governor who is willing to tax the rich."

"Gov. Cuomo's decision to block any attempt to close the state's budget gap by raising taxes on the rich is going to result in budget cuts that leave all New Yorkers worse off," he added.

Pearl continued: "The people of New York have sacrificed enough during this pandemic—it's depraved to ask them to sacrifice even more to close our state's budget gap while wealthy New Yorkers are richer now than they've ever been."

The former managing director at the investment firm Blackrock admitted that "our state's budget situation is a serious one" but noted that "it's one that's easily fixed." How? Simply "ask rich New Yorkers like me to pay our fair share, that's all it takes," he said.

Pearl is neither the first nor the only ultra-wealthy person to request that public officials hike taxes on the super-rich to fund the Covid-19 recovery effort and a better future.

In July, over 80 self-described "millionaires for humanity," including Pearl, asked governments around the world to reallocate a larger portion of the excess wealth that they and their peers hold to confront both the public health emergency and the resulting economic fallout as well as to build more egalitarian societies in the long run, as Common Dreams reported.

By urging the state government to increase taxes on its uber rich residents, Patriotic Millionaires is following the advice of progressive economists like Kitty Richards and Joseph Stiglitz of the Roosevelt Institute.

As Common Dreams reported earlier this month, Richards and Stiglitz acknowledged that "it would be better for the federal government to step in." But, the pair argued, Americans who are suffering need immediate assistance from state and local leaders who should raise revenue by taxing their high-income residents rather than "abdicate responsibility" by waiting for aid from national officials who continue to neglect the citizenry.

Other progressive economists, like Josh Bivens and Julia Wolfe of the Economic Policy Institute, continue to insist that Washington must intervene, adding that the failure of federal policymakers to provide fiscal aid to state and local governments "would be a completely foreseen and unforced blunder, one that will greatly hamper recovery and cause unnecessary suffering."

This article first appeared on Common Dreams. You can read it here.

Screenshots of the man talking to the camera and with his momTikTok |

Screenshots of the man talking to the camera and with his momTikTok |  Screenshots of the bakery Image Source: TikTok |

Screenshots of the bakery Image Source: TikTok |

A woman hands out food to a homeless personCanva

A woman hands out food to a homeless personCanva A female artist in her studioCanva

A female artist in her studioCanva A woman smiling in front of her computerCanva

A woman smiling in front of her computerCanva  A woman holds a cup of coffee while looking outside her windowCanva

A woman holds a cup of coffee while looking outside her windowCanva  A woman flexes her bicepCanva

A woman flexes her bicepCanva  A woman cooking in her kitchenCanva

A woman cooking in her kitchenCanva  Two women console each otherCanva

Two women console each otherCanva  Two women talking to each otherCanva

Two women talking to each otherCanva  Two people having a lively conversationCanva

Two people having a lively conversationCanva  Two women embrace in a hugCanva

Two women embrace in a hugCanva

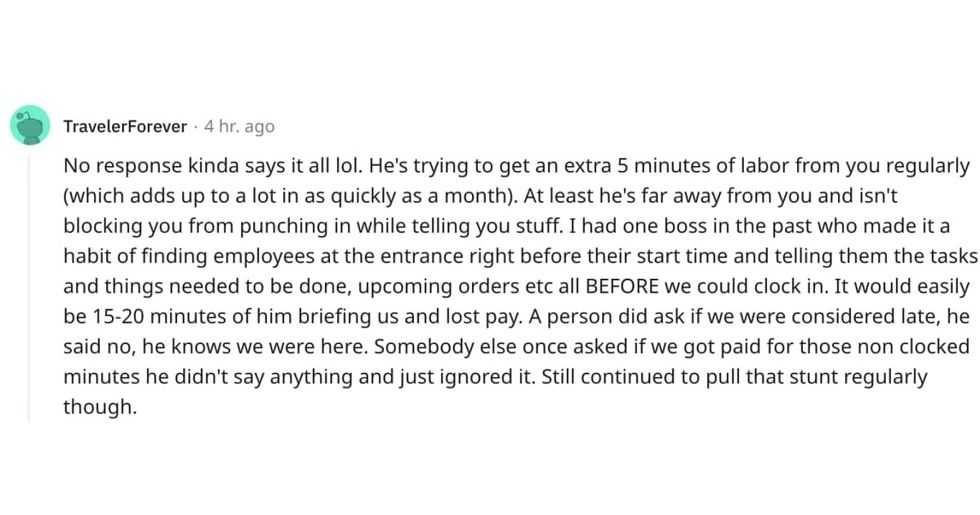

A reddit commentReddit |

A reddit commentReddit |  A Reddit commentReddit |

A Reddit commentReddit |  A Reddit commentReddit |

A Reddit commentReddit |  Stressed-out employee stares at their computerCanva

Stressed-out employee stares at their computerCanva

Who knows what adventures the bottle had before being discovered.

Who knows what adventures the bottle had before being discovered.

Gif of young girl looking at someone suspiciously via

Gif of young girl looking at someone suspiciously via

A bartender makes a drinkCanva

A bartender makes a drinkCanva