A video featuring financial guru and radio host Dave Ramsey has gone viral and has people talking about finances between their partners. In the video, Dave receives a call from a woman asking for Ramsey’s advice regarding how her boyfriend should invest a settlement he is receiving in a few months. His answer wasn’t what she was expecting.

The woman explained that her boyfriend wanted to use the settlement to outright purchase a home, whereas she thought the money would be better spent on a large down payment and get a mortgage. Ramsey was puzzled. “Why do you want a mortgage?” he asked.

The woman couldn’t quite explain why she wanted a mortgage, and Ramsey quickly shut her down.

“Let me send him a warning through you, and you’re not going to like this. There is no ‘we.’ You’re not married,” he said, bluntly. “There’s a he. It’s his money.”

Redditors commented on what’s being called a “brutal” takedown with their own opinions and theories on why she was requesting a mortgage:

“I hope bro paid for the house in full because she’s already spent the money in her head.”

“She wants a mortgage so she can co-sign it.”

“A lot of time getting a mortgage is actually better. She might have heard this but not exactly know why, which is why she's asking for advice. The number of people that default to her being a horrible stealing gold digger without any good reason is just sad.”

Getting a mortgage isn’t something that should be taken lightly, as Ramsey himself has pointed out a number of times in the past. While there could be some advantages in taking out a mortgage, generally speaking it is best not to have another monthly payment compared to outright owning your home. This is especially true during the current economic uncertainty in the United States.

@grantcardone Why A Home Is A Terrible Investment

Regardless of motives or opinions, Ramsey’s answer remains the same: It’s not her money, it’s her boyfriend’s. Ultimately, he’s the one that has the authority to do what he wants with it.

Having conflicts over money is one of the biggest hurdles in relationships, with financial compatibility being one of the gauges in which a romantic relationship is destined to succeed or fail in the long term. If you and your partner have different outlooks on how money should be used, it could turn into trouble if you were to get married. It could be especially troublesome if you end up putting your finances together.

@daveramsey When you said 'I do,' it wasn't just about love—it was about becoming ONE in everything, especially your money. Combine it, share it, and set goals together. Marriage isn't a partnership, it's unity. #relationships #relationshipadvice #moneyadvice #combinedfinances #relationshipproblems

Having finances fully integrated with your partner’s has become less common than one would think. Per Bankrate, only 43% of American couples who are married, in a civil partnership, or live together have joint accounts. Millennials are even less so with 69% of committed couples having at least one separate financial account.

In the end, if a financial windfall happens upon a person, loved ones might be able to advise and influence, but in the end it is that person’s money. Whether this woman had good or bad intentions is immaterial. However, based on expert advice in both finances and relationships, while he needs to make a financial decision on what to do with this money, they both need to figure out how this decision will impact their relationship.

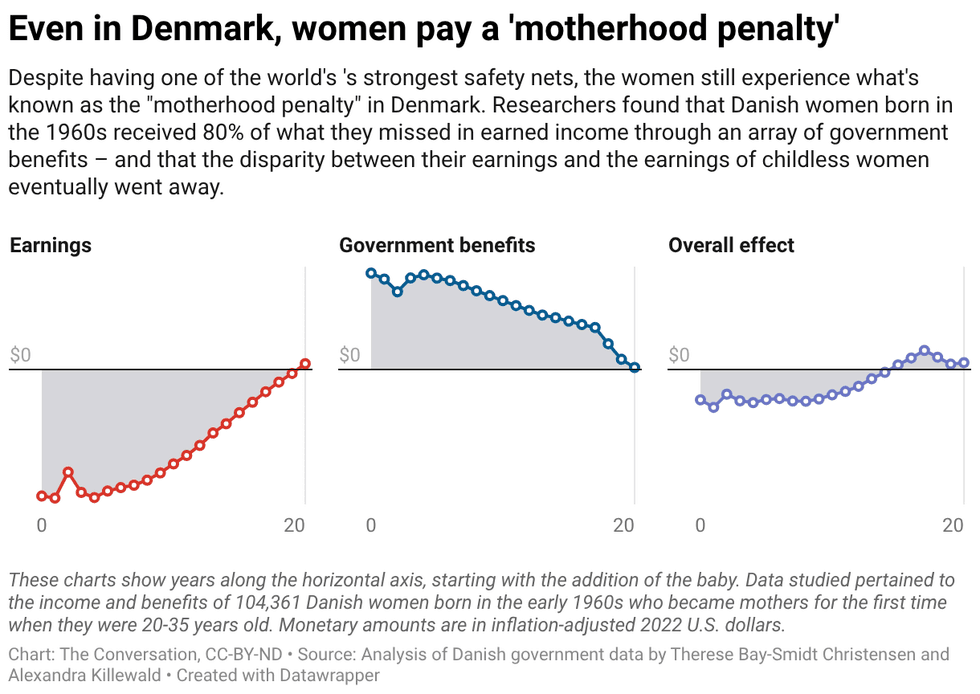

The ‘motherhood penalty’ is largest in the first year after a mom’s first birth or adoption.

The ‘motherhood penalty’ is largest in the first year after a mom’s first birth or adoption.

As mayor of Stockton, Calif., Michael Tubbs ran a pioneering program that provided a basic income to a limited number of residents.

As mayor of Stockton, Calif., Michael Tubbs ran a pioneering program that provided a basic income to a limited number of residents. Martin Luther King Jr. believed Americans of different racial backgrounds could coalesce around shared economic interests.

Martin Luther King Jr. believed Americans of different racial backgrounds could coalesce around shared economic interests.