Owning a home is a dream for so many people. It’s a sign of security, maturity, and achievement. But, times have changed and people are staying in school longer, with more debt. Marriage and children have been put on the backburner. So, 43 percent of Americans are renting, which is higher than any other time since the 1960s. But are they wasting money?

We want to know, is it really worth it to invest in a home? In this video, we help you weigh the benefits and it all comes down to thinking about where you want to live in the next five years.

And, for some Cliff’s Notes, here’s a rundown:

- There are many hidden costs to owning a home and renting may be a better bet. In fact, for the first few years of owning a home, mortgage costs aren’t paying for your house. They’re paying off interest. So, if you need to move in two years, that money disappears, just like rent.

- How can you make money when buying a new home? Returns aren’t always guaranteed. Prices of homes can always fluctuate and if you bought a home in 2006 versus 2011, you probably haven’t made a thing.

- Instead of buying, you can also rent and invest the money you’re saving because in the end, renting and buying might be more easily matched than you think.

So, depending on your situation and circumstance, renting and buying have different benefits. Just consider what will work best for you.

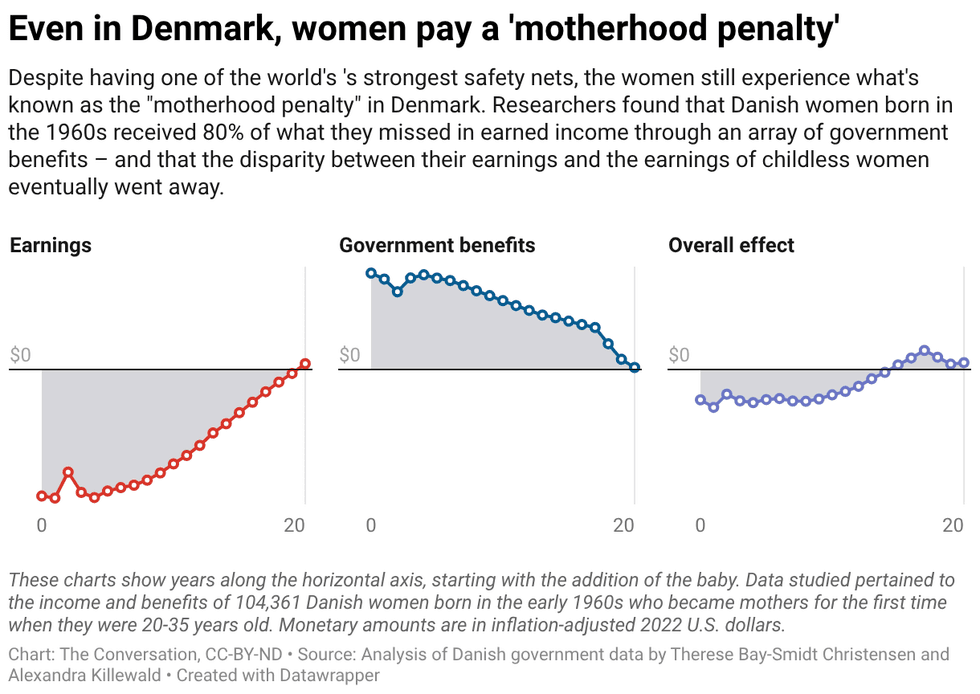

The ‘motherhood penalty’ is largest in the first year after a mom’s first birth or adoption.

The ‘motherhood penalty’ is largest in the first year after a mom’s first birth or adoption.

As mayor of Stockton, Calif., Michael Tubbs ran a pioneering program that provided a basic income to a limited number of residents.

As mayor of Stockton, Calif., Michael Tubbs ran a pioneering program that provided a basic income to a limited number of residents. Martin Luther King Jr. believed Americans of different racial backgrounds could coalesce around shared economic interests.

Martin Luther King Jr. believed Americans of different racial backgrounds could coalesce around shared economic interests.