People like to think that movie stars have it all—money, success, happiness. That they’re somehow above us average folk because we see them on TV. But in reality, celebrities are people too. Many of them weren’t wealthy when they started out, and even now, they make mistakes with their money like the rest of us. They blow their paychecks like we do, they forget about that 401k, they mess up their taxes. It turns out, having all the money in the world doesn’t necessarily mean you know what to do with it.

Some of the world’s biggest Hollywood icons talked to Wealthsimple about the role money plays in their lives—the mistakes they’ve made with it, the lessons they’ve learned, and their perspective on dough. Below are few favorite pieces of advice from the Money Diaries series.

Mad Men’s Jon Hamm

Money is a just means to an end—to pay your bills and eat

Jon Hamm was never “rich” growing up, but he was around money a lot, he says. He had friends with money—and he never thought they seemed happier than those without it. “I’ve never been driven by money—there are more important things to life,” Hamm says. “But not having money can be a hindrance. It can make life hard.” The reason to have money, to Hamm, is to take away the hurdles that come with being broke. Once those obstacles are out of the way, it doesn’t actually matter whether you have an endless amount of money or just enough to get by.

Don’t sweat every choice too much

According to Hamm, life doesn’t always get easier as you grow older—nor do you become that much wiser with age. What does grow are your responsibilities in your career and your relationships, and that can make decisions even harder. Hamm’s advice for those facing tough decisions is “not to let the stakes loom so large that making a decision becomes impossible … Keep a healthy sense of perspective.” In other words, don’t overthink it. “If you take a wrong step, you’ll find the right one,” Hamm says. “If you lose half your money, you’ll find a way to make more.”

Broad City’s Abbi Jacobson

Invest in thyself

Abbi Jacobson has been pretty careful with her money. “I get a little nervous that the success I’ve been finding won’t just keep going,” she says. So, she works hard to make sure “it all won’t go away.” At the same rate, she often asks herself what she’s working so hard for if she’s not going to enjoy it? Hence, her new mantra: If you spend money, spend it on the people you love (including yourself). “For years, I’d give people my own drawings as gifts because I couldn’t afford anything more expensive,” says Jacobson, “so now it feels good to be able to give them real gifts.” Like a coffee maker for her father. Or nice shoes for her mother. Jacobson also invests in herself: She tries to buy healthy food, even if it’s expensive—“no more potatoes for dinner”—and she recently upgraded her drawing tablet. One thing she wants to start buying more of is original artwork. She hasn’t been able to take the financial plunge quite yet, but she thinks art would be a good financial and happiness investment. “Nothing like spending your money on things that bring you joy and actually increase in value.”

The most important thing I can do with my money is to give it away

When Jacobson was younger, she was never able to donate to her favorite organizations. “Now I feel like it’s an absolute imperative,” she says. She encourages people, however stable their finances might be, to think about giving to a charity. In her experience, it’s one of the most rewarding and valuable ways to spend money.

“You feel good about yourself and you get to see the organizations whose missions you believe in continue to thrive, continue to fight the good fight. Whatever chunk it takes out of your income, that’s small potatoes.”

Girls’ Alex Karpovsky

Never stop being frugal

Alex Karpovsky is the first one to admit that he’s not that smart with money. In his 20s, he sunk most of his money in indie films: Out of the four films he made over eight years, none made any money. Girls was his first big break—and the first big check of his 40 years. For the first time in his life, he’s not living in “this cloud of nagging, swirling financial worry.” But he’s also not spending it on luxurious clothing or cars or travel. Because he knows “the money’s going to run out.” When the show ends, his life goes back to where it was before. And he’s making peace with that.

“I don’t want to say I blew through everything I made. I’m trying to be sensible and prudent with my money because I know I have to live off this money for the rest of my life. And I’m not going to win the lottery twice.”

Eat, Pray, Love’s Elizabeth Gilbert

Don’t give it all to your friends

By the time Elizabeth Gilbert was 9 years old, she was already like, “Damn, I’ve got to make some money.” At a young age, her parents explained to her that she would have to find a way to support herself in the world. They could only pay for a percentage of college; she would have to cover the rest. When she published Eat, Pray, Love, Gilbert gained a sense of financial independence she’d never experienced before. She also felt burdened by the new responsibility of this huge pile of money. So, she figured she would redistribute it among friends. “I felt I had always been an artist living close to the bone,” Gilbert says, “and I have so many friends who were living the same way. So, I felt like, ‘Wow, I got so lucky. This should be all of our good fortune.’” But some strange things happened when she tried to give it away: She inserted herself in people’s private lives more than she should have and ended up losing friends. “I didn’t realize that if you give someone money, you feel like you have the right to judge that person, as a sort of an investor in their life,” Gilbert says. “Suddenly a bunch of stuff became my business that should never have been my business in the first place.”

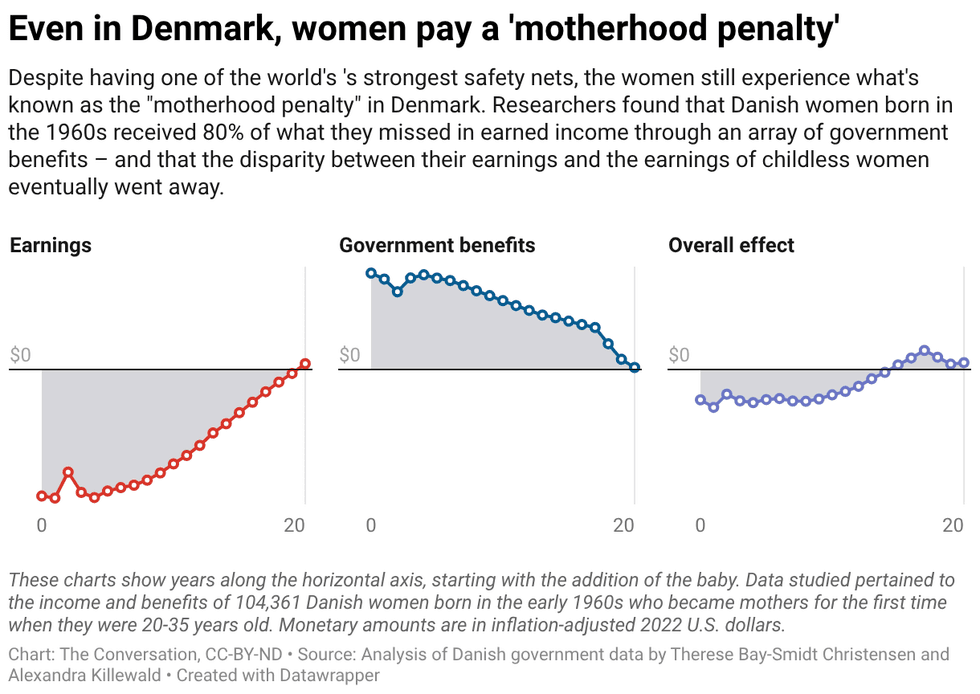

The ‘motherhood penalty’ is largest in the first year after a mom’s first birth or adoption.

The ‘motherhood penalty’ is largest in the first year after a mom’s first birth or adoption.

As mayor of Stockton, Calif., Michael Tubbs ran a pioneering program that provided a basic income to a limited number of residents.

As mayor of Stockton, Calif., Michael Tubbs ran a pioneering program that provided a basic income to a limited number of residents. Martin Luther King Jr. believed Americans of different racial backgrounds could coalesce around shared economic interests.

Martin Luther King Jr. believed Americans of different racial backgrounds could coalesce around shared economic interests.