On January 31, 2007, the long, narrow alleys and wide boulevards of Mexico City were filled with typical early morning sounds: children running through open doors; families preparing for the day; and street vendors cooking up tortillas, one of Mexico’s main food staples.

Yet this was to be no ordinary day. On this day, the price of corn— the main ingredient in tortillas—would hit an all-time high of 35 cents a pound, a price that would have been unfathomable just a year before. Corn was suddenly 400 percent more expensive than it had been just three months earlier. With half of all Mexicans living below the poverty line, a sudden increase of this magnitude was not just a nuisance, it was a potential humanitarian and political crisis.

As the sun lifted higher in the sky, the voices of tens of thousands of citizens, farmers, and union activists could be heard gathering in one of the city’s central squares. Above their heads, they raised not weapons, but ears of corn. The tortilla riots, as they came to be called, echoed throughout the day, taking over one of the main downtown streets and challenging the new government of President Felipe Calderón. Well into the evening, protestors chanted, “Tortillas sí, pan no!”—a pun on Calderón’s National Action Party, the PAN, which also means “bread” in Spanish—and barked out their suspicions about just who was behind the rise in prices: the government, big business, and the wealthy elite of the country. Union leaders and television celebrities railed against corporations for price fixing and chastised the beef and pig ranchers for hoarding their grains.

While the ranchers and political leaders were natural objects of class indignation, they were not, this time at least, the principal culprits. Indeed, the protestors could scarcely have guessed the truth: The slowly burning fuse that had ignited the explosion in corn prices had been lit several years before and a thousand miles away by a seemingly disconnected event—Hurricane Katrina.

Here’s how: In August 2005, the impending winds of the devastating hurricane had prompted the mass evacuation and shutdown of the 2,900 oil rigs that dot the Gulf Coast from Texas to Louisiana, disrupting almost 95 percent of oil production in the Gulf for several months.

In the aftermath of the storm, the price of gasoline in America surged, in some places by as much as 40 cents per gallon in a single day. This spike in oil prices made corn—the primary ingredient in the alternative fuel ethanol—look relatively cheap by comparison and spurred investment in domestic ethanol production. U.S. farmers, among the most efficient and most heavily subsidized in the world, were encouraged to replace their edible corn crops with inedible varieties suitable for ethanol production. By 2007, even Congress had gotten in on the act, mandating a fivefold increase in biofuel production—with more than 40 percent of it to come from corn.

Amid the euphoria of this ethanol investment bubble, almost no one considered potential impacts on Mexico’s peasant farmers, who, in the decade between the passage of NAFTA and the arrival of Katrina, had found themselves thrust into international competition with powerhouse U.S. agribusinesses north of their border. American corn growers routinely sold (many would argue dumped) their product on Mexican markets at almost 20 percent less than it cost to produce it. Unable to keep up—even with the support of their own domestic subsidies—many rural Mexican farmers had switched the variety of corn they grew, switched crops altogether, or abandoned their farms, swelling the ranks of Mexico City’s underclass and further accelerating Mexico’s position as a primary market for cheap U.S. varieties.

As NAFTA took hold, this expanding corn import market had also become increasingly dominated by a tiny clique of powerful transnational corporations, mostly headquartered in the United States, including Cargill and Archer Daniels Midland, along with their Mexican subsidiaries. These companies accelerated the transition already at work by doing what dominant incumbents instinctively do: concentrating power, tightening their control over the market, and squeezing out smaller suppliers. The result: Mexico, famous as the place that domesticated the growing of corn ten thousand years ago, soon became a net food importer—the third largest of U.S. agricultural products—much of it channeled through a tiny constellation of companies.

It was against this backdrop that, in the year that followed Katrina, with increasing amounts of the United States’ domestic supply being diverted to ethanol, the price of corn became inextricably coupled to the price of oil—not only because ethanol and oil are comparable fuels, but also because it takes an enormous amount of petroleum-derived fertilizers to grow corn in the first place. As the price of a barrel of petroleum fluctuated, the price of a bushel of corn began increasingly to move in lockstep. When global speculation drove the cost of a barrel of oil to nearly $140, the now-linked price of corn also skyrocketed, provoking what may become an archetypal experience of the twenty-first century: a food riot.

We are, of course, used to these kinds of stories. Each week, it seems, brings some unforeseen disruption, blooming amid the thicket of overlapping social, political, economic, technological, and environmental systems that govern our lives. They arrive at a quickening yet erratic pace, usually from unexpected quarters, stubbornly resistant to prediction. The most severe become cultural touchstones, referred to in staccato shorthand: Katrina. Haiti. BP. Fukushima. The Crash. The Great Recession. The London mob. The Arab Spring. Other nameless disruptions swell their ranks, amplified by slowly creeping vulnerabilities: a Midwestern town is undone by economic dislocation; a company is obliterated by globalization; a way of life is rendered impossible by an ecological shift; a debt crisis emerges from political intractability. If it feels like the pace of these disruptions is increasing, it’s not just you: It took just six months for 2011 to become the costliest year on record for natural disasters, a fact that insurance companies tie unambiguously to climate change. Volatility of all sorts has become the new normal, and it’s here to stay.

While the details are always different, certain features of these disruptions are remarkably consistent, whether we’re discussing the recent global financial crisis, the geopolitical outcomes of the war in Iraq, or the surprising consequences of a natural disaster. One hallmark of such events is that they reveal the dependencies between spheres that are more often studied and discussed in isolation from one another. The story of the tortilla riots, for example, makes visible the linkages between the energy system (the oil rigs) the ecological system (Katrina), the agricultural system (the corn harvest), the global trade system (NAFTA), social factors (urbanization and poverty), and the political systems of both Mexico and the United States.

We tell such stories to encourage humility in the face of the incomprehensible complexity, interconnectivity, and volatility of the modern world—one in which upheavals can appear to be triggered by seemingly harmless events, arrive with little warning, and reveal hidden, almost absurd correlations in their wake. Like pulling on an errant string in a garment, which unravels the whole even as it reveals how the elements were previously woven together, we make sense of these stories only in retrospect. Even with a deep understanding of the individual systems involved, we usually find it difficult to untangle the chain of causation at work. And for all of the contributions of the much-ballyhooed Information Age, just having more data doesn’t automatically help. After all, if we could actually see each of the individual packets of data pulsing through the internet, or the complex chemical interactions affecting our climate, could we make sense of them? Could we predict in detail over the long term where those systems are headed or what strange consequences might be unleashed along the way? Even with perfect knowledge, one can’t escape the nagging suspicion we’re ballroom dancing in the middle of a minefield.

So what to do?

If we cannot control the volatile tides of change, we can learn to build better boats. We can design—and redesign—organizations, institutions, and systems to better absorb disruption, operate under a wider variety of conditions, and shift more fluidly from one circumstance to the next. To do that, we need to understand the emerging field of resilience.

Andrew Zolli is an author and Curator and Executive Director of PopTech, a global innovation network. This post is an excerpt from his new book Resilience: Why Things Bounce Back.

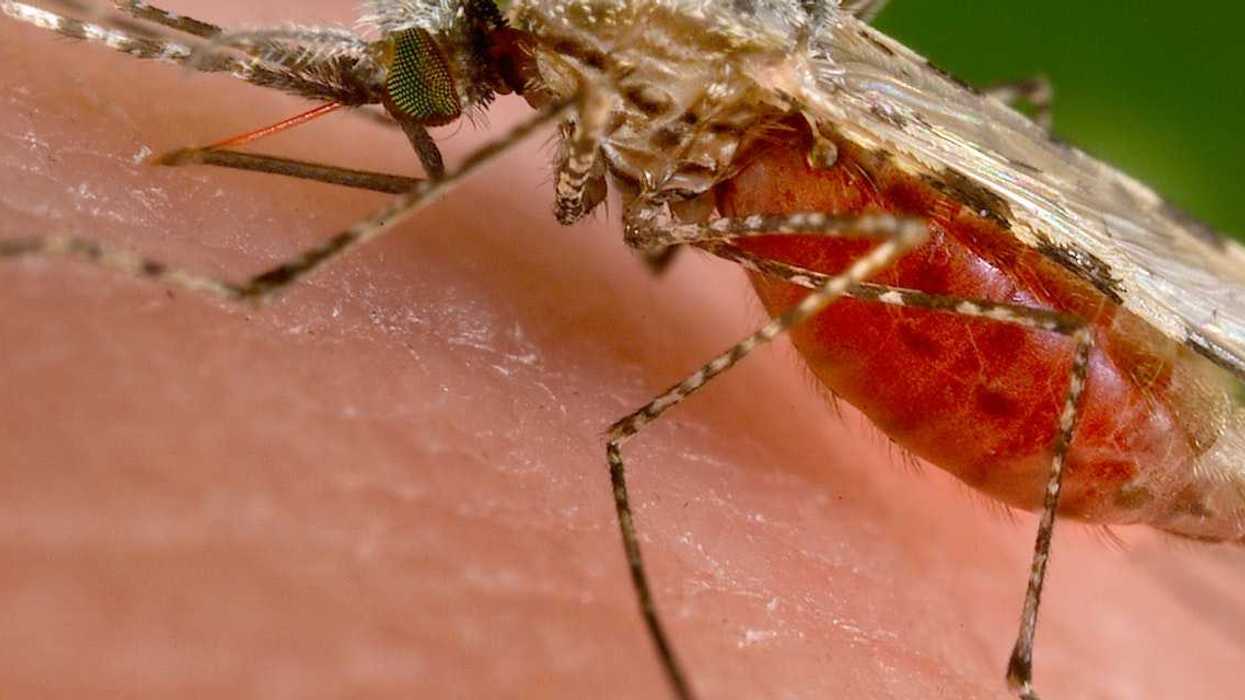

Image from Wikimedia Commons

A young teen cries while listening to music via

A young teen cries while listening to music via

A young couple waits in line at a coffee shopCanva

A young couple waits in line at a coffee shopCanva Gif of Eddie Murphy telling you to think

Gif of Eddie Murphy telling you to think

Volunteers who drive homeless people to shelters talk with a person from Ukraine in Berlin on Jan. 7, 2026.

Volunteers who drive homeless people to shelters talk with a person from Ukraine in Berlin on Jan. 7, 2026.

Leonard Cohen performs in Australia in 2009.Stefan Karpiniec/

Leonard Cohen performs in Australia in 2009.Stefan Karpiniec/  Enjoying a sunset.Photo credit

Enjoying a sunset.Photo credit

An envelope filled with cashCanva

An envelope filled with cashCanva Gif of someone saying "Oh, you

Gif of someone saying "Oh, you