This article was originally published by Pro Publica. You can read it here.

Sen. Richard Burr will be stepping aside as chairman of the Senate Intelligence Committee during the investigation into his stock trades, Senate Majority Leader Mitch McConnell announced Thursday.

"Senator Burr contacted me this morning to inform me of his decision," McConnell wrote in a statement. "We agreed that this decision would be in the best interests of the committee and will be effective at the end of the day tomorrow."

FBI agents served a search warrant to Burr at his Washington, D.C.-area home on Wednesday night as part of an investigation into stock sales he made in February before the stock market crash in response to the coronavirus pandemic, the Los Angeles Times reported.

The North Carolina Republican turned his cellphone over to federal agents, the newspaper reported, citing an unidentified law enforcement official. Another unnamed law enforcement official told the paper that the FBI previously had used another warrant to obtain access to Burr's Apple iCloud account as part of its investigation.

Burr came under scrutiny after ProPublica reported in March that he sold off a significant percentage of his stocks shortly before the market declined, unloading between $628,000 and $1.72 million of his holdings on Feb. 13 in 33 separate transactions.

As chairman of the intelligence committee and a member of the health committee, Burr had access to the government's most highly classified information about threats to America's security and public health concerns.

On the same day, Burr's brother-in-law, Gerald Fauth, a member of the National Mediation Board, sold between $97,000 and $280,000 worth of shares in six companies — including several that have been hit particularly hard in the market swoon and economic downturn. A person who picked up Fauth's phone previously declined to comment.

Before his sell-off, Burr had assured the public that the federal government was well-prepared to handle the virus.

In a Feb. 7 op-ed that he co-authored with another senator, he said "the United States today is better prepared than ever before to face emerging public health threats, like the coronavirus."

That month however, according to a recording obtained by NPR, Burr had given a VIP group at an exclusive social club a much more dire preview of the economic impact of the coronavirus, warning it could curtail business travel, cause schools to be closed and result in the military mobilizing to compensate for overwhelmed hospitals.

Burr's Senate spokesperson declined to comment, as did the FBI.

Burr has defended his actions, saying he relied solely on public information, including CNBC reports, to inform his trades and did not rely on information he obtained as a senator.

ProPublica has also reported that Burr has frequently traded in medical stocks while working on legislation that could impact the industry, made a timely sale of his stake in an obscure Dutch fertilizer company before its stock plummeted and sold his Washington townhouse to a lobbyist and donor who had business before his committees.

Screenshots of the man talking to the camera and with his momTikTok |

Screenshots of the man talking to the camera and with his momTikTok |  Screenshots of the bakery Image Source: TikTok |

Screenshots of the bakery Image Source: TikTok |

A woman hands out food to a homeless personCanva

A woman hands out food to a homeless personCanva A female artist in her studioCanva

A female artist in her studioCanva A woman smiling in front of her computerCanva

A woman smiling in front of her computerCanva  A woman holds a cup of coffee while looking outside her windowCanva

A woman holds a cup of coffee while looking outside her windowCanva  A woman flexes her bicepCanva

A woman flexes her bicepCanva  A woman cooking in her kitchenCanva

A woman cooking in her kitchenCanva  Two women console each otherCanva

Two women console each otherCanva  Two women talking to each otherCanva

Two women talking to each otherCanva  Two people having a lively conversationCanva

Two people having a lively conversationCanva  Two women embrace in a hugCanva

Two women embrace in a hugCanva

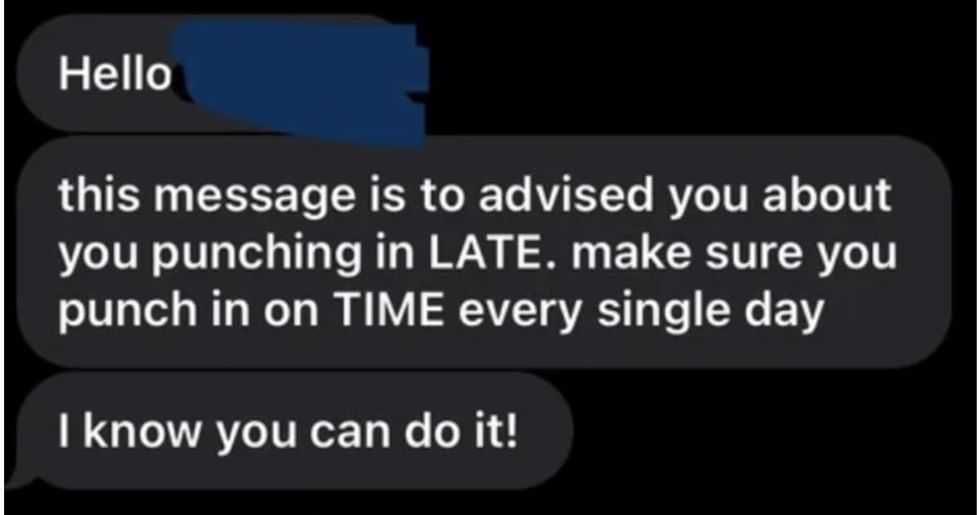

A reddit commentReddit |

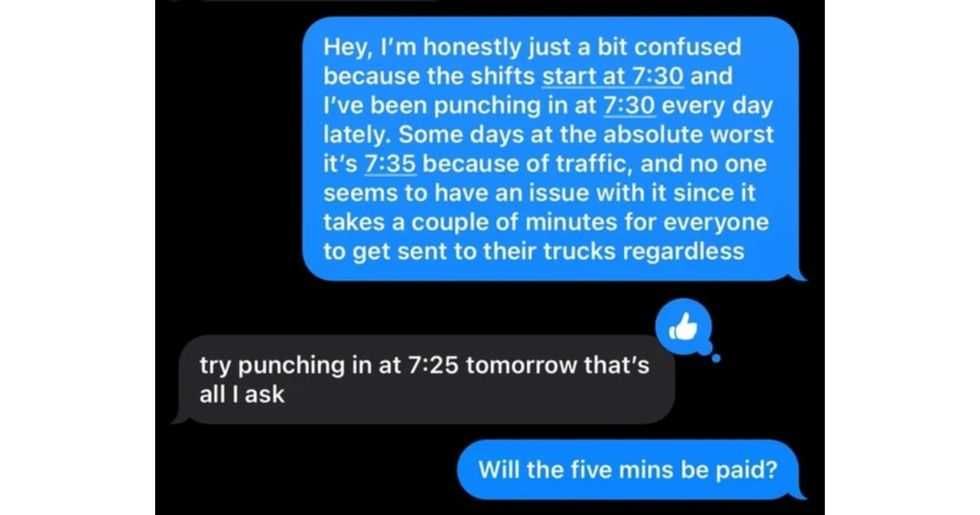

A reddit commentReddit |  A Reddit commentReddit |

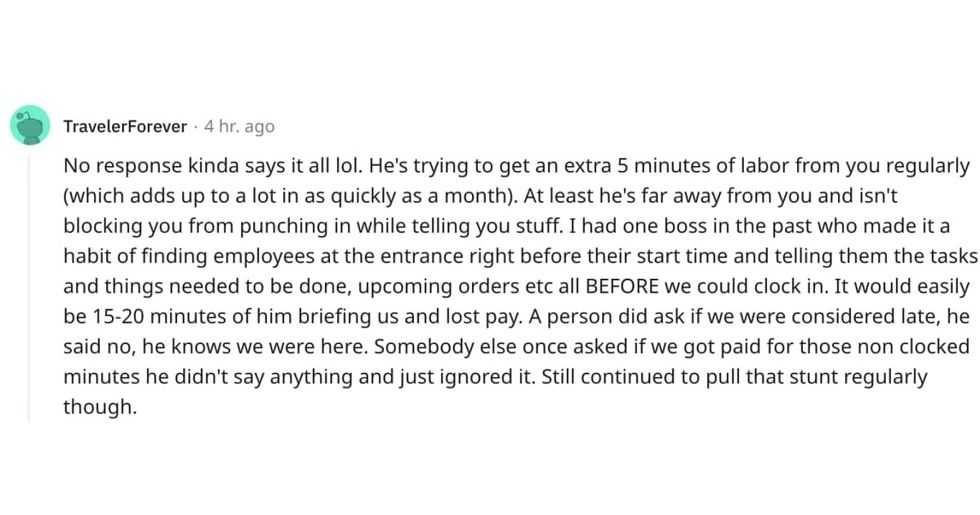

A Reddit commentReddit |  A Reddit commentReddit |

A Reddit commentReddit |  Stressed-out employee stares at their computerCanva

Stressed-out employee stares at their computerCanva

Who knows what adventures the bottle had before being discovered.

Who knows what adventures the bottle had before being discovered.

Gif of young girl looking at someone suspiciously via

Gif of young girl looking at someone suspiciously via

A bartender makes a drinkCanva

A bartender makes a drinkCanva