The traditional fantasy of American “energy independence” goeS something like this: U.S. companies drill more oil from domestic wells in Alaska, North Dakota, Texas, and the Gulf of Mexico than our cars and houses can burn through; our soldiers return from the Middle East, for good, as the oil fields in Saudi Arabia, Kuwait, Iraq, and elsewhere in the region don’t matter to us anymore; we’ve broken the back of OPEC; and the so-called “radical” Arab sheikhs and South American dictators hold no geopolitical sway over us. Massive strip mines, natural gas fracking, and nuclear plants keep electricity cheap in American homes, and we bolster our economy while exporting enough fracked gas to Europe to relieve Russia’s energy stranglehold on our NATO allies.

Sounds great, right? It’s easy to see the popular (and populist) appeal in this vision of energy self-reliance, with Trump integrating it into one of the many executive orders that have punctuated his first 100 days in office. But the truth is that America has already nearly achieved “energy independence”—and our global energy systems are much more complicated than any one nation’s attempts to stand alone.

The expression’s descent to meaningless meme

Trump is far from the first to summon a call for “energy independence.” In fact, as historian Dr. Peter Shulman of Case Western Reserve University told me, “Every president since Nixon has used the phrase on the campaign trail or while president."

[quote position="left" is_quote="true"]All told, the United States is already on track to become a net energy exporter in under a decade.[/quote]

The expression itself first hit the mainstream in spring of 1973, months before the Arab oil embargo, mind you, when an MIT academic named Caroll Wilson gave a speech to the Council of Foreign Relations, warning about the energy crisis the American public faced. In his speech, later published as an article in Foreign Affairs, Wilson argued that the only way to protect the American public from price shocks was to invest heavily in domestic energy production and achieve “energy independence.” Months later, according to Shulman, “the embargo hits, followed by two months of crisis—massive political, economic, social crisis—and Nixon picks up the phrase.”

The pursuit made a lot more sense in Nixon’s day than it does now. American energy consumption—and particularly oil consumption—was growing fast, and after domestic oil production peaked in 1970, imports more than doubled over the next three years.

“It’s a different problem now,” explains Shulman. “We have a strategic petroleum reserve, we have a lot of domestic production today, we have efficiency standards. We have a much more diversified portfolio of fuels. We didn’t have any of those things in the ’70s.”

Taken at face value, energy independence would seem to imply that the United States produces all the energy that it consumes, though most seem to allow for a trade balance where our energy resource exports match or exceed our imports. Adam Siegel, a national security professional with decades of experience in energy, argues that the concept “doesn’t stand up to scrutiny by serious people.”

“If you want to take the concept to its logical extreme,” Siegel told me, “then you have to consider who built the drill bits that are being used to drill wells, who’s making the parts for the refineries, who is conducting the science and research.”

Shulman echoes the sentiment, saying that “even Nixon and Bush and Clinton realized having true independence didn't mean anything. They didn’t actually mean energy self-sufficiency, or only exporting energy. They actually meant and worked towards not importing so much that it becomes a national security risk.”

And Trump has, when pressed, given a looser definition, promising to make America “totally independent of any need to import energy from the OPEC cartel or any nations hostile to our interest” (emphasis mine). Meanwhile, a search on Google for usage of the phrase “energy independence” reveals that it’s almost as fashionable now as it was in the 1980s:

It’s all about oil, really, and Obama pretty much got us there already

Let’s allow though, for sake of discussion, that balancing our our energy exports and imports could be celebrated as some kind of “energy independence.” Well, wouldn’t you know, we’re almost already there. Let’s look at the most recent data from the Energy Information Agency’s Monthly Energy Report, published last month: The United States is already a net exporter of coal and refined petroleum products (like gasoline and diesel, the forms of oil that are actually put to use). We are just about breaking even on natural gas, and will be a firm exporter within a year or two. Crude oil is the only energy resource of which we have a significant net import imbalance—and America’s crude oil imports have been steadily dropping for over a decade now.

[quote position="right" is_quote="true"]It’s drill baby drill in another language.[/quote]

Meanwhile, imports from OPEC nations, in particular, have fallen every year over the past decade, and are at the lowest levels since 1987. So the “OPEC dependency,” as perceived by Trump and others, turns out to be relatively minor. All told, according to projections from the Energy Information Agency, under current policies, the United States is already on track to become a net energy exporter in under a decade—with no help from Trump whatsoever.

While OPEC members might secretly be concerned—their fortunes have certainly grown enormously given America’s oil addiction—you’d be hard-pressed to find an expert who sees American “energy independence” as a critical threat to OPEC.

Even if the United States were to boost crude exports to levels matching our imports, we’ll still be tied up with OPEC because of the type of crude that Americans consume. Joseph Dutton explained on The Conversation:

With such low relative imports from OPEC, it could be assumed that ending imports from them would be simple; however the type of oil they supply is equally important. Most U.S.-produced oil is known as “sweet” crude, because of its low sulphur content and density. But countries such as Saudi Arabia and Venezuela produce “sour” crude. Sweet crude is less energy intensive, but cheaper and easier to refine. However, much of the oil refinery capacity in the U.S.–notably on the Gulf coast–is designed to process sour and heavy oil because of the historic import dependency.

What’s more, because of OPEC’s strong position globally—the cartel controls 56 percent of crude exports globally and holds 81 percent of the proven oil reserves worldwide—when the cartel decides to pump more or less crude into the global market, it is uniquely powerful in setting prices. Because crude oil is traded globally, like wheat or gold, U.S. producers don’t have direct impact on domestic gasoline or heating oil prices.

The global oil market also means that the threat of OPEC cutting off supply to the United States and harming American consumers is nonsense. As Jason Bordoff, a former energy adviser to President Obama, explained in The Wall Street Journal, “Today’s oil market is the largest and most liquid commodity market on earth. That means that if Saudi Arabia stopped sending oil to the U.S., companies would just buy it from other suppliers.”

In fact, as the benefits of diversified supplies and redundancies in a global energy market far outweigh the negatives. Bordoff continued:

We are more secure, not less, when energy markets are interdependent. When Hurricanes Rita and Katrina disrupted much of the Gulf Coast’s vast production and refining capacity, fuel shortages were averted by the ability to import supplies quickly from the global market. When U.S. refiners lost access to large volumes of imports from Venezuela in 2002 and 2003 during a worker strike there, they replaced the disrupted supplies and avoided shortages with imports from other countries. In both cases, free trade in a highly integrated global energy market made us more secure.

Even OPEC officials recognize this reality. The United States “benefits more than anybody else from global free trade,” Khalid Al-Falih, Saudi Arabia’s energy minister, told the Financial Times, pointing to the United States increasing exports of refined oil products and natural gas.

Easier to save a barrel than drill a barrel

So where does this all leave us? Basically, the United States is importing, on net (or after subtracting out exports), fewer than 5 million barrels of crude daily, roughly 3 million barrels of which comes from OPEC. That’s the extent of our energy “dependency,” so to speak. And, again, it’s way down from the all-time high of around 13 million barrels per day of net imports in 2005.

At current consumption levels, according to Bloomberg, to balance out our imports and exports of crude, the United States would have to double domestic production. But there’s a better—cheaper, cleaner, less carbon intensive—way.

According to analysis by that Natural Resources Defense Council, it’s cheaper and better for the economy to reduce oil consumption through efficiency programs than it is to drill for new crude in the difficult shale and offshore fields that we’d need to open up to meet our demand.

“It’s easier to take a barrel out of the economy through efficiency than to drill for a new barrel,” as Siegel put it.

You don’t have to look any farther than the fuel efficiency standards that are already on the books, set by the Obama administration, for ways to reduce our demand to equal domestic production. The Obama White House estimated that by 2025, these auto standards would cut consumption by 2 million barrels per day. NRDC’s analysis found that that number would grow to 3 million barrels per day by 2030.

In other words, the Obama fuel efficiency standards will cut oil demand by roughly the same amount as we currently import from OPEC. If President Trump simply leaves those standards alone, he will get his wish of eliminating the crude deficit with OPEC.

[quote position="full" is_quote="true"]It’s easier to take a barrel out of the economy through energy efficiency than to drill for a new barrel.[/quote]

Instead, Trump’s agencies are reviewing the fuel efficiency standards and the president has threatened to roll them back. Meanwhile, President Trump recently signed the “Executive Order on Promoting Energy Independence and Economic Growth,” which, you may recall, dealt mostly with coal mining and the Clean Power Plan’s impact on coal-burning power plants. (To be fair, one part, Section 7, did call for a review of oil and gas regulations, but the heft of the order was a helping hand for the coal industry.) And coal has no part in any rational discussion of energy dependency.

If the United States is serious about producing more energy than it consumes, the quickest fix is to drive cars that burn less oil. We can also drive less, by improving mass transit options to reduce miles driven nationwide.

When “energy independence” first entered the lexicon, there were legitimate threats to American fuel supplies. The oil embargo did real economic damage to the United States. But that's not the landscape anymore—thanks in large part to energy efficiency policies that were passed in the 1970s.

Yet, today, we’re being sold the “energy independence” bill of goods as a way to ease restrictions for fossil fuel companies that want to drill and mine now—whether or not Americans actually need the fuel now.

“The energy independence argument is a shallowly disguised path to profitability to Trump allies,” said Siegel. “It’s drill baby drill in another language.”

Screenshots of the man talking to the camera and with his momTikTok |

Screenshots of the man talking to the camera and with his momTikTok |  Screenshots of the bakery Image Source: TikTok |

Screenshots of the bakery Image Source: TikTok |

A woman hands out food to a homeless personCanva

A woman hands out food to a homeless personCanva A female artist in her studioCanva

A female artist in her studioCanva A woman smiling in front of her computerCanva

A woman smiling in front of her computerCanva  A woman holds a cup of coffee while looking outside her windowCanva

A woman holds a cup of coffee while looking outside her windowCanva  A woman flexes her bicepCanva

A woman flexes her bicepCanva  A woman cooking in her kitchenCanva

A woman cooking in her kitchenCanva  Two women console each otherCanva

Two women console each otherCanva  Two women talking to each otherCanva

Two women talking to each otherCanva  Two people having a lively conversationCanva

Two people having a lively conversationCanva  Two women embrace in a hugCanva

Two women embrace in a hugCanva

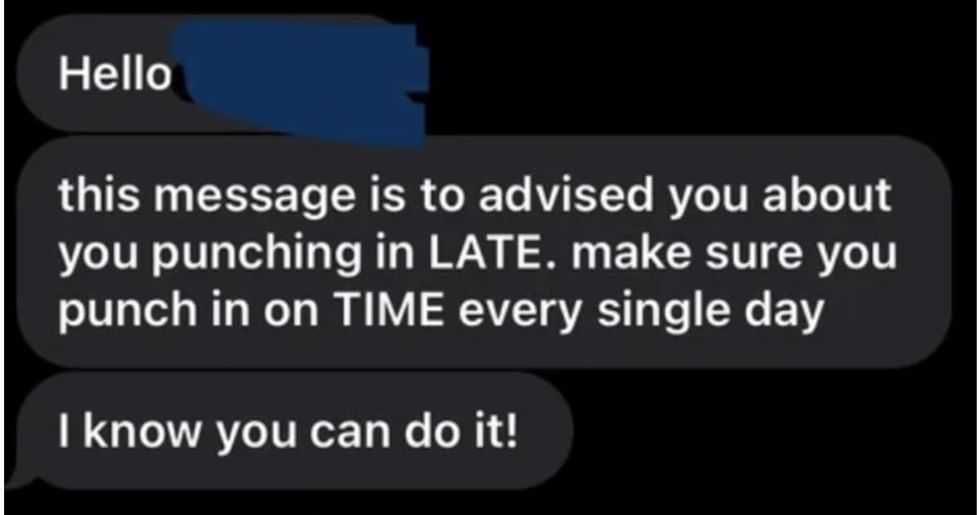

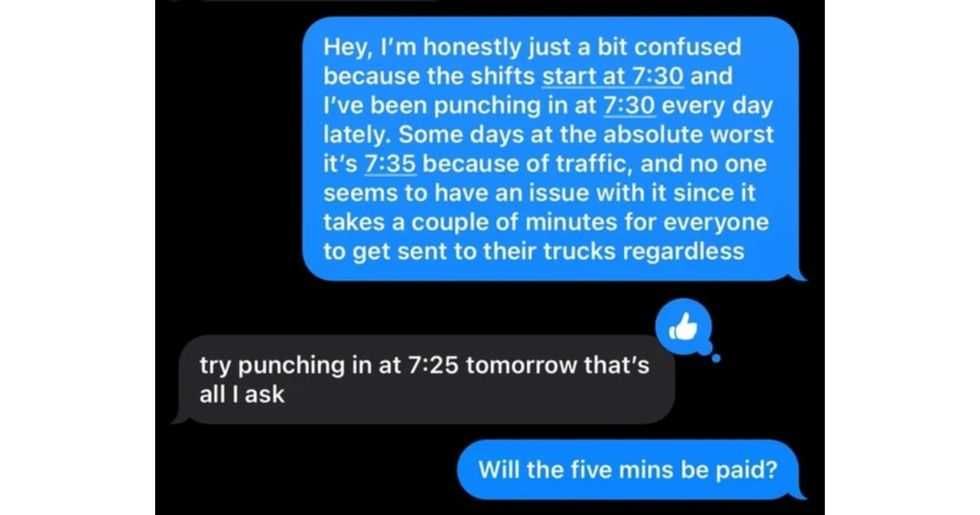

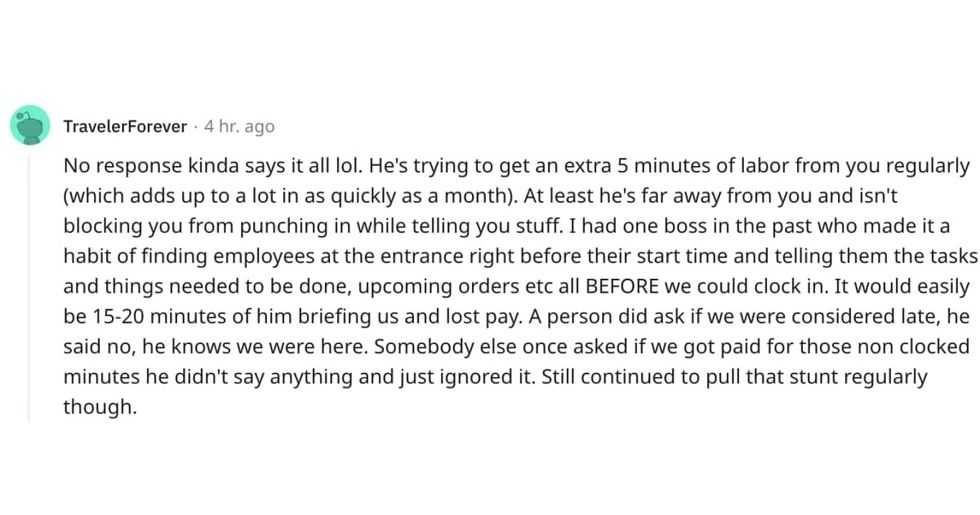

A reddit commentReddit |

A reddit commentReddit |  A Reddit commentReddit |

A Reddit commentReddit |  A Reddit commentReddit |

A Reddit commentReddit |  Stressed-out employee stares at their computerCanva

Stressed-out employee stares at their computerCanva

Who knows what adventures the bottle had before being discovered.

Who knows what adventures the bottle had before being discovered.

Gif of young girl looking at someone suspiciously via

Gif of young girl looking at someone suspiciously via

A bartender makes a drinkCanva

A bartender makes a drinkCanva