University of Washington cornerback Sidney Jones worked his entire life for this moment, his pro day performance for NFL scouts interested in drafting him into the league. The two-time All-Pac-12 selection turned out of a backpedal, clutched his left leg and went down with what doctor’s later diagnosed as a torn Achilles tendon. Projected by some sports writers as the 11th pick in the NFL draft, Jones’ entire career was now in question.

Currently, college players are required to play through their junior year or reach a certain age before becoming eligible for the NFL. This forces young prospects to put in their time (unpaid) for a college team, risking injury while waiting to reach the age of eligibility. There’s no way to eliminate, or really even mitigate, the risks associated with playing football, other than by not playing. So in an effort to hedge their professional bets, many college players have invested in insurance vehicles that offer some payment or compensation should the college game affect their value as NFL players.

These career protection policies are complicated and multifaceted, but they ultimately act like any other insurance policy. These policies can pay a player if he suffers a career-ending injury or if an injury causes his draft stock—and thus his earning potential—to fall.

Just last week, we saw perhaps the most high-profile instance to date with Michigan tight end Jake Butt in the draft. From ESPN:

The Denver Broncos selected Butt with the first pick of the fifth round at No. 145 overall, ending a slide stemming from his torn ACL in the Orange Bowl against Florida State.

Butt had taken a $2 million loss-of-value policy that he started collecting insurance on when he wasn't picked in the top half of the third round Friday night.

He first started collecting, at $10,000 a pick tax-free, in the middle of the third round, a source with knowledge of the policy with ISI told ESPN. By being passed over in the fourth round as well, Butt was set to receive $543,000 on the policy.

The Michigan tight end wasn’t the first player to take out this type of policy and the practice seems to be growing more common. With NFL careers growing shorter, a player’s rookie contract takes on far more importance as the likelihood of a career beyond the life of the initial contract is smaller and smaller.

Of course, players are forced to pay these insurance premiums out of pocket and most full-time student-athletes are unable to pay the premiums, which can range from $25,000 and up. Critics question why the NCAA, which profits immensely from these player’s talents and risky practices, won’t pay the premiums on the players’ behalf.

The NCAA, on its website, addresses the question by claiming that they don’t “consistently benefit student-athletes who file a claim.” They offer no supporting evidence as to why, but here’s the statement in full:

The NCAA provides permanent total disability (PTD) coverage, which protects athletes who suffer an injury or illness that prevents them from ever competing as a professional athlete. But the NCAA does not offer LoV insurance at this time because the coverage has not been shown to consistently benefit student-athletes who file a claim. Only one former student-athlete is known to have benefited from LoV coverage out of the hundreds who are believed to have purchased the coverage.

It’s a tough argument for the NCAA to maintain after the organization recently complained about players declaring early for the NFL draft and sitting out bowl games in order to avoid an injury that might impact their NFL draft status and career.

Robert Redford advocating against the demolition of Santa Monica Pier while filming "The Sting" 1973

Robert Redford advocating against the demolition of Santa Monica Pier while filming "The Sting" 1973

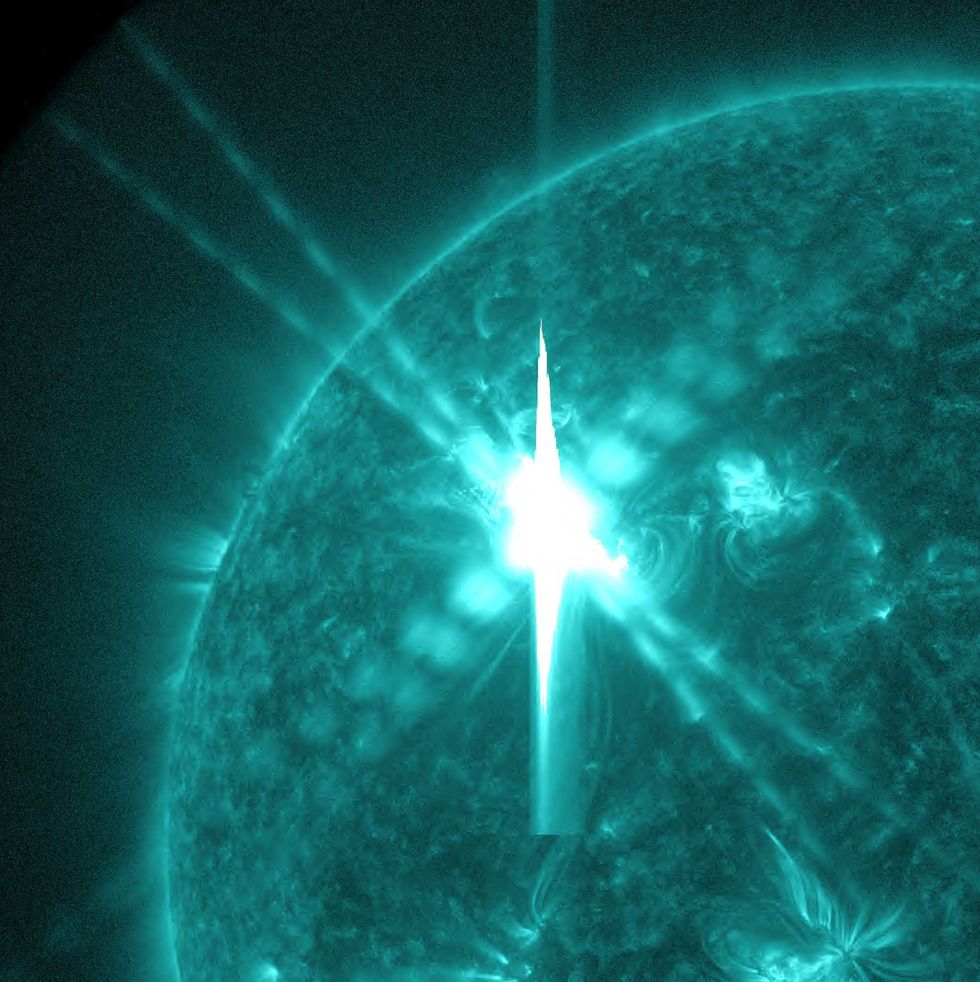

Image artifacts (diffraction spikes and vertical streaks) appearing in a CCD image of a major solar flare due to the excess incident radiation

Image artifacts (diffraction spikes and vertical streaks) appearing in a CCD image of a major solar flare due to the excess incident radiation

Ladder leads out of darkness.Photo credit

Ladder leads out of darkness.Photo credit  Woman's reflection in shadow.Photo credit

Woman's reflection in shadow.Photo credit  Young woman frazzled.Photo credit

Young woman frazzled.Photo credit

A woman looks out on the waterCanva

A woman looks out on the waterCanva A couple sits in uncomfortable silenceCanva

A couple sits in uncomfortable silenceCanva Gif of woman saying "I won't be bound to any man." via

Gif of woman saying "I won't be bound to any man." via  Woman working late at nightCanva

Woman working late at nightCanva Gif of woman saying "Happy. Independent. Feminine." via

Gif of woman saying "Happy. Independent. Feminine." via