According to the Pew Research Center, 73.9 million people in the United States collect some form of Social Security benefit. By design, it has become a primary source of income for retirees in our country to help boost their accounts and pay for needs during their golden years. As the economy ebbs and flows, it can still be difficult for retired people to make ends meet even with Social Security benefits. However, a new map could help those folks find a place to live where their Social Security funds stretch further.

A new map created through data collected by Realtor.com has found ten states in the U.S. in which retirees could live comfortably off their Social Security benefits alone—provided their mortgage has been paid off. That is considered the most important factor. While other costs such as food, transportation, and health care are factors, the difference in those costs from state to state is minimal compared to the cost of shelter. If the cost of housing is lower, the more surplus Social Security money a person can have to use elsewhere.

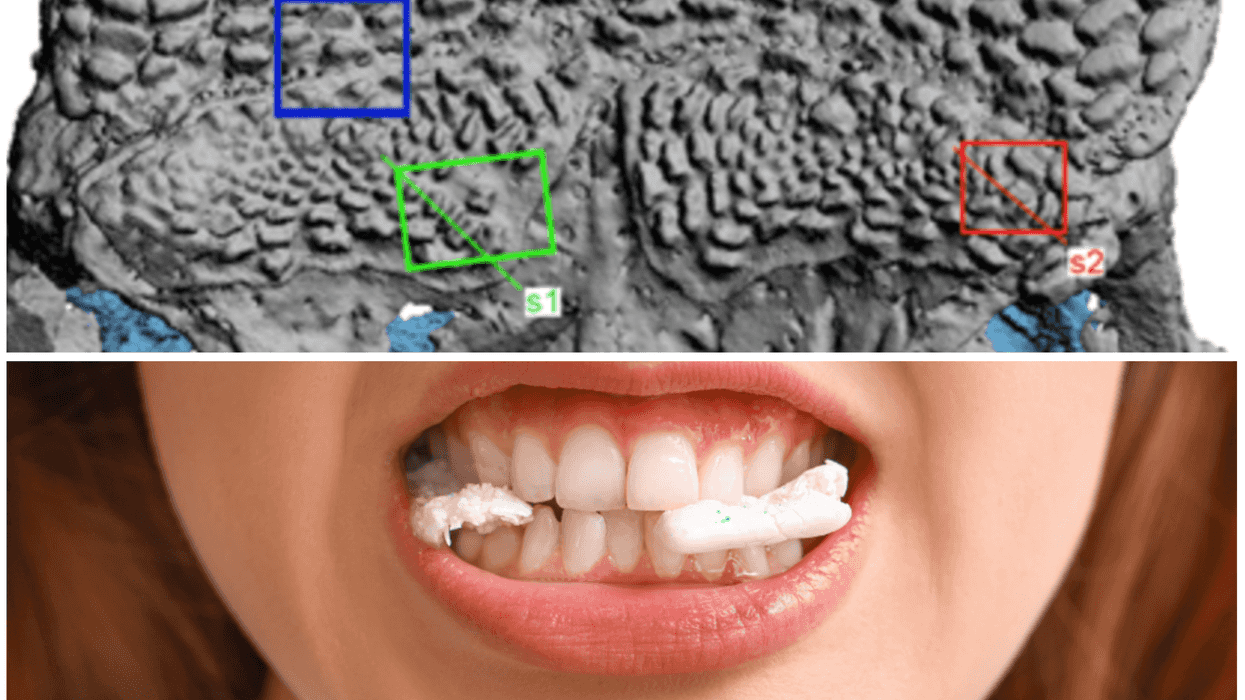

@boomerincomeblueprint Ever wonder how retirees survive on $2,000/month Social Security? Social Security reality check 😰 Here's what most people don't know: 21.8 million seniors rely on Social Security alone. That's about 4 in 10 older Americans, 📊 and it's similar in Australia where 62% of seniors aged 65+ rely on the Age Pension alone, also $2000 a month. $2,000/month sounds okay until you do the math. Rent $1,200, utilities $150, Medicare $200 = $1,550 gone. What's left? $450 per mth for food, medicine, transportation, EVERYTHING else 💔 Most "survivors" are barely existing, not living. One car repair or medical bill = disaster 🚨 The people who make it work either own their homes outright, live in very cheap rural areas, or qualify for assistance programs. Even then, they're choosing between groceries and medicine 😔 67 percent of seniors rely on Social Security for more than half their income, and this isn't rare, it's the reality for millions 💪 That's why I'm building backup income at 66, because Social Security, the Pension here in Australia is survival, not retirement. If you're worried about your future too, you're not alone. There are other options for people our age willing to take action 🤝 Ready to explore what's possible? Let's chat about creating your backup plan. Follow first, and Comment BACKUP and I'll send you a video link explaining how the plan works. #PensionReality #RetirementPlanning #FinancialPlanningOver50 #RetirementIncome #BackupIncomeNeeded

Where can I live off of Social Security alone?

Of the ten states, Delaware tops the list as mortgage-free retirees would have $1,764 of an annual surplus as their median monthly benefits there are around $2,139, and the average monthly costs are $1,992. This is followed by Indiana with a $1,392 annual surplus, Arizona with a $1,224 annual surplus, Utah with $888, and South Carolina with $828. The rest of the top ten ends with West Virginia, Alabama, Nevada, Tennessee, and Michigan, in which Michigan ekes out with only $132 in annual surplus funds.

@geenaildefonso We’re not explicity told or educated on the fact that our hard earned money each month taken out for social security is being used right now to pay people who are in retirement. #money #finances #retirement #socialsecurity #life #taxes #inflation #americans #relatable #millennial #genz #genx

It’s important to keep in mind that “make ends meet” and “living well” are different from person to person, situation to situation. There are some states in which $100 stretches further than others, and the cost of living can also vary within the states themselves. Even a retiree living in Delaware would have a harder time living off of their Social Security benefits if they lived in Greenville compared to Wilmington. It also cannot be stressed enough that these ten states allow those with Social Security benefits to live off them alone if their mortgage has been fully paid off, and that some folks might still have to live a leaner lifestyle with a strict budget.

@lovepeacecruise Nancy and Robert Houchens of Charlottesville, Virginia - Couple retires to live on cruise ships because it's 'cheaper than a nursing home' #livingonacruiseship #retirement #carnival #carnivalcruise #funship #carnivalship #carnivalshiptok #cruiseship #cruise #cruiser #cruiselife #vacation #travel #cruisevacation #cruisetravel #cruisetok #cruisetiktok #cruiseaddict

Living on Social Security alone isn't "living" for many people

This is partially why you may have read some stories about retirees choosing to live off-land on cruise ships for their retirement rather than on owned property. Regardless of which state you live in, a great majority of Americans are trying to find ways to have their money go further whether it’s using free services online, finding cheaper alternatives to shopping at stores, and even moving to a different country.

@vanderbilt_money 🇧🇿 8 Countries That Offer Retirement Visas to Americans

If you’re approaching retirement age and have concerns, the National Council on Aging has some suggestions. Social Security is just one of the programs you’ll qualify for when you reach retirement age, and there are others that can provide financial assistance for health care (such as Medicare), housing, energy, wireless/phone service, and food alongside your benefits. If you’re active and full-time retirement isn’t for you, you can work part-time or as a freelancer in many different fields. You could take on a hobby such as woodworking, photography, or something of that nature to turn into a part-time side hustle for extra income, too. Living your golden years well can only be defined by you and, fortunately, there are a number of options out there to help you achieve that goal, whether you can live off of Social Security alone or not.

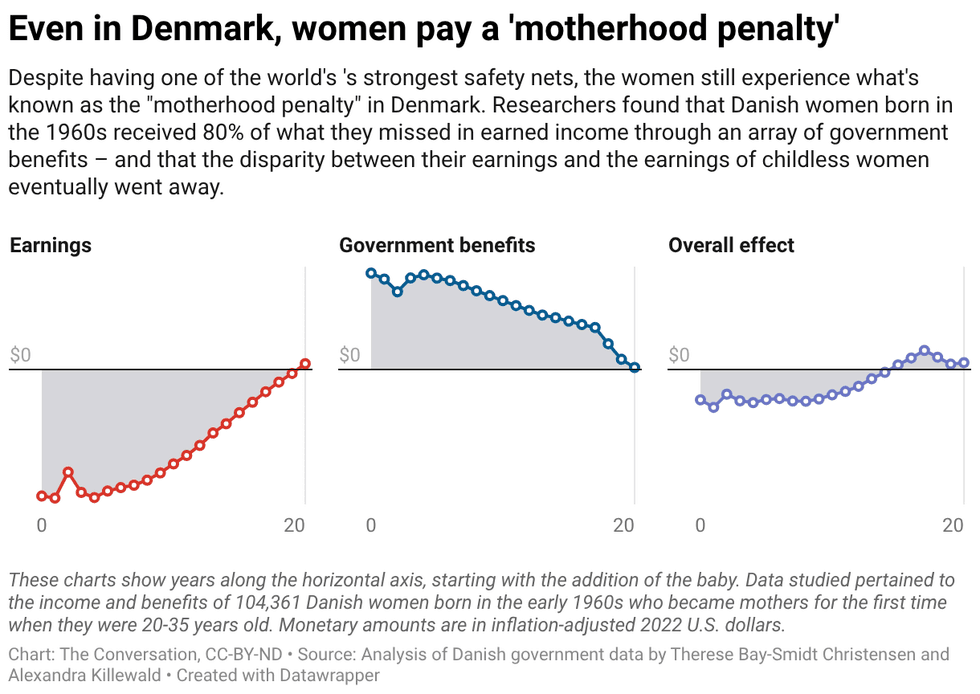

The ‘motherhood penalty’ is largest in the first year after a mom’s first birth or adoption.

The ‘motherhood penalty’ is largest in the first year after a mom’s first birth or adoption.

As mayor of Stockton, Calif., Michael Tubbs ran a pioneering program that provided a basic income to a limited number of residents.

As mayor of Stockton, Calif., Michael Tubbs ran a pioneering program that provided a basic income to a limited number of residents. Martin Luther King Jr. believed Americans of different racial backgrounds could coalesce around shared economic interests.

Martin Luther King Jr. believed Americans of different racial backgrounds could coalesce around shared economic interests.